Are you ready to capitalize on the eco-friendly benefits of owning an electric vehicle (EV)? Don’t forget to claim your well-deserved EV tax credit! In this comprehensive guide, we’ll walk you through the essential steps to prepare your tax documents for claiming the EV tax credit seamlessly. As you switch gears to a greener lifestyle, we’re here to make sure you enjoy the financial incentives too. So, buckle up and let’s turbocharge your tax savings with the ultimate guide to mastering your EV tax credit claim.

Understanding the EV Tax Credit: Eligibility Criteria and Benefits

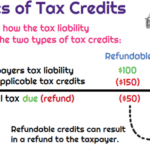

In order to effectively claim the Electric Vehicle (EV) Tax Credit, it’s essential to understand its eligibility criteria and benefits. The EV Tax Credit, a valuable incentive for purchasing an eco-friendly vehicle, is available to US taxpayers who purchase an eligible electric or plug-in hybrid car. Eligibility is based on factors such as battery capacity, vehicle weight, and the number of qualifying vehicles sold by the manufacturer. The tax credit amount ranges from $2,500 to $7,500, depending on the car’s battery size and other specifications. By familiarizing yourself with these requirements and benefits, you can maximize your tax savings and contribute to a cleaner environment.

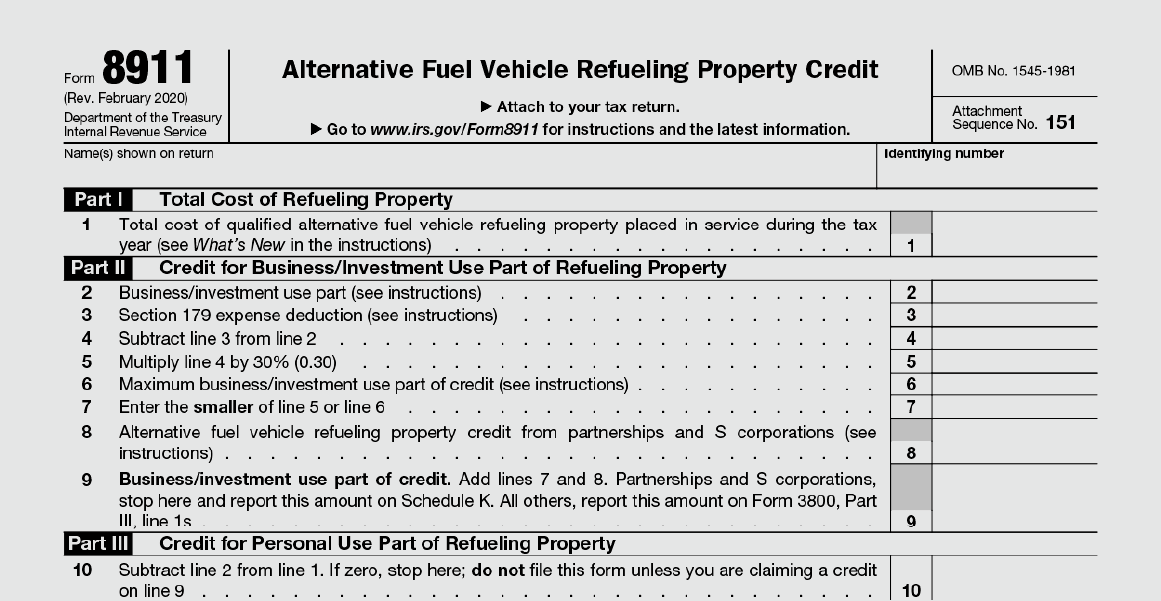

Essential Tax Documents for Claiming the EV Tax Credit: What You Need to Know

When claiming the EV Tax Credit, it’s crucial to have all the essential tax documents in order. To ensure a seamless process, gather key documents such as the IRS Form 8936 – Qualified Plug-in Electric Drive Motor Vehicle Credit, purchase or lease agreement, and proof of vehicle registration. These documents will help verify your eligibility for the tax credit and provide crucial information such as the vehicle’s purchase price, date of acquisition, and vehicle identification number (VIN). By understanding the requirements and staying organized, you can maximize your EV Tax Credit claim and contribute to a greener, more sustainable future.

Organizing and Submitting Your EV Tax Credit Documentation: Step-by-Step Guide

In our comprehensive step-by-step guide, we’ll walk you through the process of organizing and submitting your Electric Vehicle (EV) tax credit documentation with ease. Properly preparing these essential documents can help maximize your tax savings and streamline the process. We’ll cover everything from gathering required information, such as the VIN and purchase details of your EV, to completing and submitting the IRS Form 8936. Our SEO-optimized guide aims to simplify this often-confusing process, ensuring you navigate the EV tax credit requirements successfully and reap the financial benefits this eco-friendly incentive has to offer.

Common Mistakes to Avoid When Applying for the EV Tax Credit: Expert Tips

When applying for the EV Tax Credit, it’s crucial to avoid common mistakes that may jeopardize your chances of receiving the full benefit. One common error is neglecting to include the proper documentation, such as the Manufacturer’s Certification Statement, which verifies your vehicle’s eligibility. Additionally, ensure your tax form (Form 8936) is filled out accurately and completely, including the correct vehicle identification number (VIN) and purchase date. To maximize your credit, be aware of any phase-out limitations for specific manufacturers and don’t overlook any state or local incentives that may be available. By staying vigilant and thorough when preparing your tax documents, you can confidently claim the EV Tax Credit and enjoy the financial perks of driving an eco-friendly vehicle.

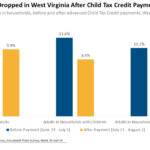

Maximizing Your EV Tax Credit Savings: Additional Deductions and Credits to Consider

Maximize your EV tax credit savings by exploring additional deductions and credits that may be available to you. Consider options such as the Solar Investment Tax Credit (ITC) for installing solar panels, home energy efficiency tax credits, and other state or local incentives for eco-friendly upgrades. Research your eligibility for these programs and gather the necessary documentation to support your claims. By taking advantage of these opportunities, you can further reduce your tax liability, ultimately increasing your overall savings. Stay informed about the latest tax incentives and updates to ensure you’re making the most of your investment in electric vehicles and green technology.

GIPHY App Key not set. Please check settings