Financing an electric vehicle can seem like a daunting task, especially if you’re a student. With so many options and considerations to take into account, it’s easy to feel overwhelmed. But don’t worry – this article will walk you through the process and provide you with tips to make the process easier. You’ll learn about different financing options, how to compare them and even how to get the most out of your purchase. After reading, you’ll be well-informed and ready to make the best decision for your budget and lifestyle.

Research electric vehicle options.

When researching electric vehicle options, it’s important to consider your budget, lifestyle, and other needs. I recommend looking into different models and prices, reading reviews, and checking out EV-focused websites. Make sure to compare specs and features and consider what type of charger you’ll need. Don’t forget to research any incentives or rebates available in your area, too!

Calculate total cost.

Calculating the total cost of an electric vehicle can seem daunting, but there are some simple steps to make it easier. First, consider your budget and research all the options available to you. Don’t forget to factor in car tax, insurance, and any other costs associated with owning and maintaining a car. Once you’ve done that, you can get a clearer picture of the total cost of your electric vehicle. With a bit of research and careful planning, financing an electric vehicle can be an affordable and rewarding experience.

Consider financing options.

Financing an electric vehicle can be a great way to save money in the long run. Consider financing options such as bank loans or leasing to get the best deal on the vehicle. Shop around different banks and dealerships to compare interest rates and terms. If you’re a student, you may be eligible for special financing options. Ask your parents or guardians for help if you need it.

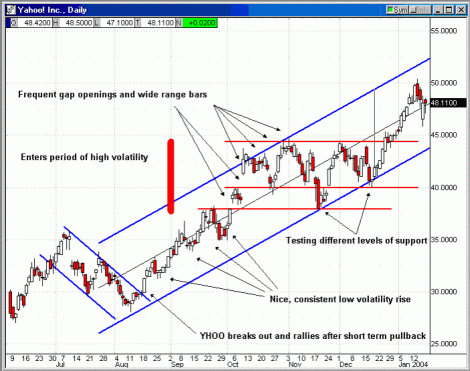

Compare loan rates/terms.

When it comes to financing an electric vehicle, it’s important to compare loan rates and terms. Different lenders offer different rates and terms, so shop around. Look for lenders that offer special rates for electric vehicles, and explore options for low or no interest loans. Be sure to read the fine print and understand all the terms and conditions before signing.

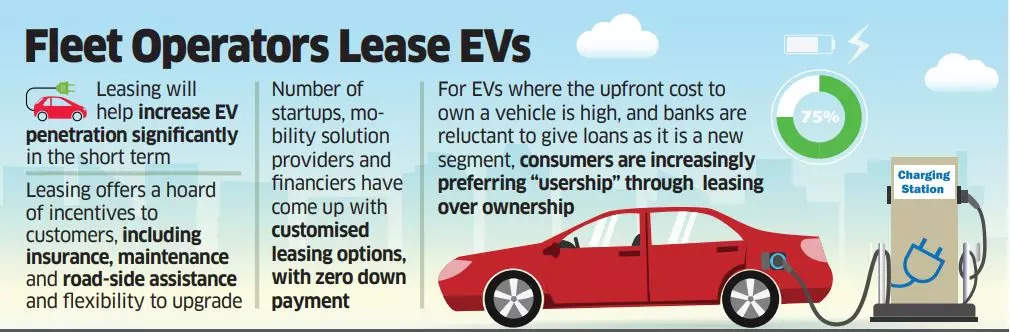

Compare leasing options.

Leasing an electric vehicle is an option to consider when financing. It can be cheaper than buying outright and you don’t have to worry about re-selling when the lease is up. Make sure to compare the different leasing options available, including the down payment and monthly payment amounts, the length of the lease, and any additional fees. Don’t forget to read the fine print and ask questions so you can make an informed decision.

Choose best financing plan.

Choosing the best financing plan for an electric vehicle can be overwhelming. It’s important to explore all the options available, such as leasing, buying second-hand, or taking out a loan. Consider the costs, interest rates, and other factors that might influence your decision. Do your research and compare the plans to find the best option for you.

GIPHY App Key not set. Please check settings