Are you an electric vehicle (EV) owner or are you looking to buy one soon? If so, then you’re in luck! There are some awesome tax credits and incentives available to EV owners that can really maximize your savings. In this article, I’ll be explaining how you can make the most of these credits and incentives to get the most bang for your buck. So if you’re an EV owner or you’re thinking about buying one, keep reading to find out how you can maximize your electric vehicle tax credits and incentives!

Research local incentives.

When researching electric vehicle tax credits and incentives, it’s important to look into local options. Check with your state government and local energy companies to see what kind of credits and rebates they offer. If you’re lucky, you might be able to score a great deal on your electric car purchase. Don’t forget to look for charging station incentives and green energy credits, too!

Calculate credit amount.

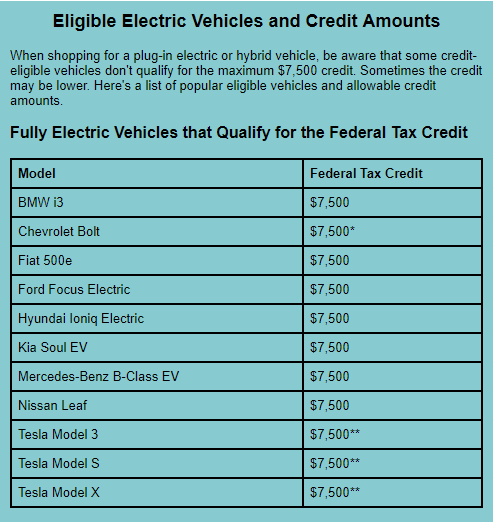

Calculating the amount of your electric vehicle tax credits and incentives can be a bit tricky. It’s all based on the make and model of your vehicle, as well as your state’s regulations and tax codes. To find the exact amount of credits and incentives you’re eligible for, talk to a qualified tax professional or look up your vehicle’s information online. You can also use an online calculator to estimate the credits and incentives you may qualify for.

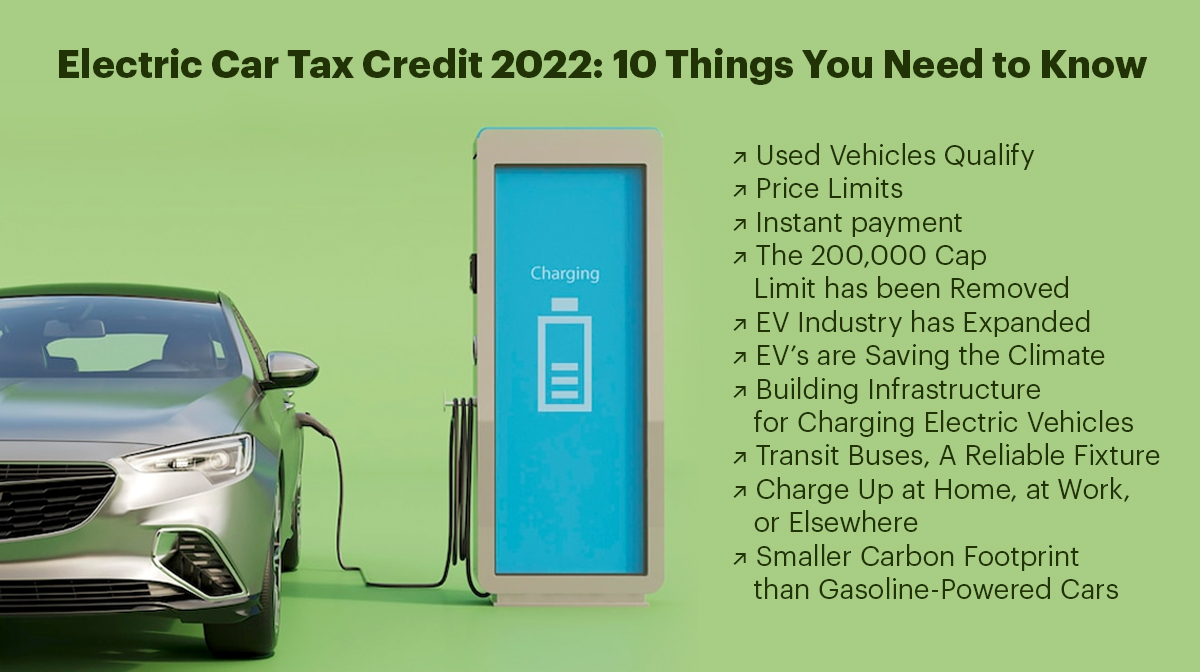

Compare EV models.

Comparing different electric vehicle models is essential to maximize your tax credits and incentives. Check out the different models from brands like Tesla, Nissan, and Ford to find the one that works best for you. Compare performance, features, and the size of the battery to get the most bang for your buck. Don’t forget to factor in tax credits and incentives when you’re ready to make your decision.

Utilize tax deductions.

If you own an electric vehicle (EV), you may be eligible for federal, state, and local tax deductions. These deductions can help reduce the cost of owning an EV and make it more affordable. To maximize your tax deductions, make sure to keep track of all of your expenses related to the vehicle, including registration fees, insurance, and maintenance. Additionally, confirm with your tax professional that you’re eligible for the deductions and incentives available in your area.

Track expenses.

Tracking expenses is key to maximizing your electric vehicle tax credits and incentives. As an 18 year old college student, I highly recommend using a budgeting and tracking app to stay organized and on top of your expenses. Not only will it help you maximize your tax credits and incentives, but it will also help you build a good financial foundation and help you save money in the long run.

Claim credits.

Claiming electric vehicle tax credits and incentives can be confusing, but the payoff could be huge. It’s important to research the incentives available in your state to make sure you’re taking advantage of all available credits and deductions. Make sure you have all the necessary documents ready before filing, like vehicle registration and proof of purchase. Stay organized and consult a tax expert if you’re unsure about anything.

GIPHY App Key not set. Please check settings