Are you considering going green with an electric vehicle (EV) and want to make the most of your investment? If so, you’re in luck! Our comprehensive guide on how to calculate your potential EV tax credit savings is here to help you maximize your benefits and drive off into a sustainable future. With the ever-growing popularity of electric vehicles, it’s essential to understand the financial incentives available to consumers, such as federal tax credits, which can significantly reduce the upfront cost of your eco-friendly ride. So, buckle up and get ready to explore the ins and outs of EV tax credits and boost your savings with our easy-to-follow, step-by-step guide!

Understanding the EV Tax Credit: How It Works and Its Benefits

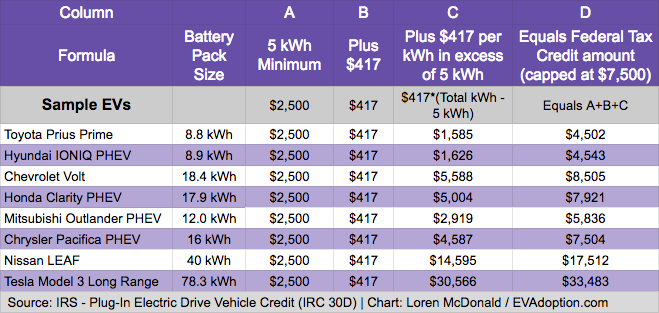

Delving into the world of electric vehicles (EVs) can be both exciting and rewarding, especially when you factor in the potential savings from the EV tax credit. This federal incentive program aims to encourage the adoption of eco-friendly transportation by providing a tax credit of up to $7,500 based on the vehicle’s battery capacity. By understanding how the EV tax credit works and its numerous benefits, you can maximize your savings while contributing to a greener future. In this comprehensive guide, we’ll break down the process of calculating your potential EV tax credit savings, allowing you to make an informed decision and reap the financial rewards of driving an electric car.

Eligibility Criteria for EV Tax Credits: Maximizing Your Savings

Understanding the eligibility criteria for Electric Vehicle (EV) tax credits is crucial for maximizing your potential savings. Firstly, ensure that the vehicle you plan to purchase qualifies for the credit, as it must be a new, plug-in electric model with a battery capacity of at least 4 kilowatt-hours. Additionally, the tax credit begins to phase out once a manufacturer sells 200,000 eligible vehicles. Keep in mind that leasing an EV may not entitle you to the full credit, as it typically goes to the leasing company. Lastly, your tax liability plays a significant role in determining your savings, as the credit is non-refundable and can only offset your owed federal taxes.

Step-by-Step Guide to Calculating Your EV Tax Credit Savings

Discover the simple, step-by-step guide to calculating your EV tax credit savings and unlock the benefits of going green with your next vehicle purchase. This comprehensive guide will help you understand the federal tax credit program for electric vehicles, and how much you could potentially save by making the switch to an eco-friendly car. Learn how to determine your eligibility, find the right EV model for you, and calculate your own estimated tax credit savings. With this essential knowledge, you’ll be well on your way to driving a greener, more sustainable future while enjoying significant savings on your taxes. Don’t miss out on this incredible opportunity to save money and embrace an environmentally friendly lifestyle with your next vehicle purchase.

Top Electric Vehicles with Impressive Tax Credit Savings

Discover the top electric vehicles offering impressive tax credit savings and enhance your eco-friendly lifestyle while enjoying substantial financial benefits. Our comprehensive list features the latest and most sought-after EV models eligible for federal tax credits, including the Tesla Model 3, Chevrolet Bolt EV, and Nissan Leaf. By understanding the specific tax credit amounts for each vehicle, potential savings become more transparent, making your decision to switch to an electric car even more rewarding. Optimize your purchase by comparing various EV models and their respective tax incentives, ensuring you choose the perfect eco-conscious vehicle that aligns with your budget and sustainability goals.

How to Claim Your EV Tax Credit: Tips and Best Practices

To maximize your EV tax credit savings, it’s essential to understand the claiming process, and follow the best practices. Begin by researching the eligible electric vehicles to ensure your desired model qualifies for the credit. Next, consult a tax professional for guidance on the intricacies of Form 8936 and other relevant tax forms. Be prepared to provide documentation for your EV purchase, including the sales contract and invoice. Additionally, monitor changes to tax laws and credits, as these may impact your savings. By staying informed and engaging professional assistance, you can confidently claim your EV tax credit, optimizing your overall savings.

GIPHY App Key not set. Please check settings