Are you considering joining the electric vehicle (EV) revolution and looking to save some cash in the process? You’re in the right place! In this comprehensive guide, we’ll explore the essential requirements for qualifying for the Federal EV Tax Credit, a lucrative incentive that could save you up to $7,500 on your next eco-friendly ride. From eligibility criteria to credit limits, we’ve got you covered with all the crucial information you need to make an informed decision and reap the maximum benefits from your green investment. So, buckle up and let’s dive into the world of Federal EV Tax Credits and unlock the potential savings waiting for you!

Understanding the Federal EV Tax Credit: The Basics and Benefits

Understanding the Federal EV Tax Credit is crucial for those considering an electric vehicle purchase. This significant financial incentive aims to promote the adoption of environmentally-friendly transportation, offering a tax credit of up to $7,500 on qualifying electric vehicles. The benefits of this credit are twofold: it helps reduce the upfront cost of EVs, making them more accessible, and it encourages the use of sustainable transportation options, ultimately reducing emissions and the nation’s dependence on fossil fuels. By familiarizing yourself with the basic criteria and advantages of the Federal EV Tax Credit, you can make an informed decision when purchasing an electric vehicle and ultimately contribute to a greener future.

Eligibility Criteria for the Federal EV Tax Credit: Meeting the Prerequisites

To qualify for the Federal Electric Vehicle (EV) Tax Credit, you must meet specific eligibility criteria that determine if you’re entitled to claim this valuable incentive. First and foremost, the purchased or leased vehicle must be new, fully electric, or a plug-in hybrid with a battery capacity of at least 4 kWh. Additionally, the car must be primarily used for personal, family, or business purposes and be driven mainly in the United States. The tax credit is nonrefundable, so the vehicle owner must have sufficient tax liability to claim the credit. Remember, the amount of the credit varies depending on the vehicle’s battery capacity and manufacturer sales, so it’s crucial to research your desired EV model before making a purchase.

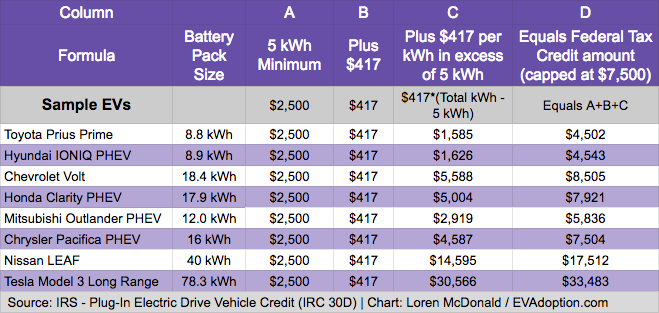

The Role of Battery Capacity in Qualifying for EV Tax Credit: A Closer Look

The Role of Battery Capacity in Qualifying for EV Tax Credit: A Closer LookBattery capacity plays a crucial role in determining the eligibility of your electric vehicle (EV) for the Federal EV Tax Credit. The minimum requirement to qualify is a battery capacity of at least 4 kWh. The higher the battery capacity, the larger the tax credit you may receive, up to a maximum of $7,500. By understanding the relationship between battery capacity and tax credit value, you can make informed decisions when purchasing an EV and maximize your potential savings. Keep in mind that not all EVs qualify, so it’s essential to verify the battery capacity of your chosen model to ensure you benefit from this valuable incentive.

How to Claim Your Federal EV Tax Credit: A Step-by-Step Guide

In this comprehensive step-by-step guide, learn how to claim your Federal EV Tax Credit and maximize your savings on eco-friendly transportation. Begin by understanding the essential requirements for qualifying vehicles, such as battery capacity and gross vehicle weight. Next, familiarize yourself with the necessary tax forms, including Form 8936, to successfully claim the credit. Get helpful tips on how to navigate the IRS website, calculate your potential tax credit, and ensure that you don’t miss out on any valuable incentives. By following these straightforward steps and opting for an electric vehicle, you can contribute to a greener planet while enjoying significant financial benefits.

Maximizing Your EV Tax Credit: Tips for Making the Most of the Federal Incentive

Maximizing your EV tax credit is essential to fully benefit from the federal incentive program for electric vehicles. To optimize your savings, consider purchasing an eligible EV model before the manufacturer’s tax credit phase-out period begins. Stay updated on any changes to the federal tax credit and state incentives, as these may affect your potential savings. Additionally, consult with a tax professional to ensure you meet all necessary qualifications, including income tax liability and vehicle ownership requirements. By strategically planning your electric vehicle purchase and being well-informed on the federal EV tax credit, you can make the most of this valuable financial incentive.

GIPHY App Key not set. Please check settings