Are you looking to purchase an electric vehicle (EV) and curious about the enticing EV tax credit? Look no further! Our comprehensive guide will walk you through the process of seeking professional tax advice to maximize your savings and make the most of this eco-friendly incentive. With expert tips and insider knowledge, we’ll help you navigate the world of tax credits, deductions, and benefits, ensuring that you have all the information you need to make an informed decision. So, buckle up and get ready to unlock the potential of the EV tax credit with the help of top-notch tax professionals.

Understanding the EV Tax Credit: A Comprehensive Guide for Taxpayers

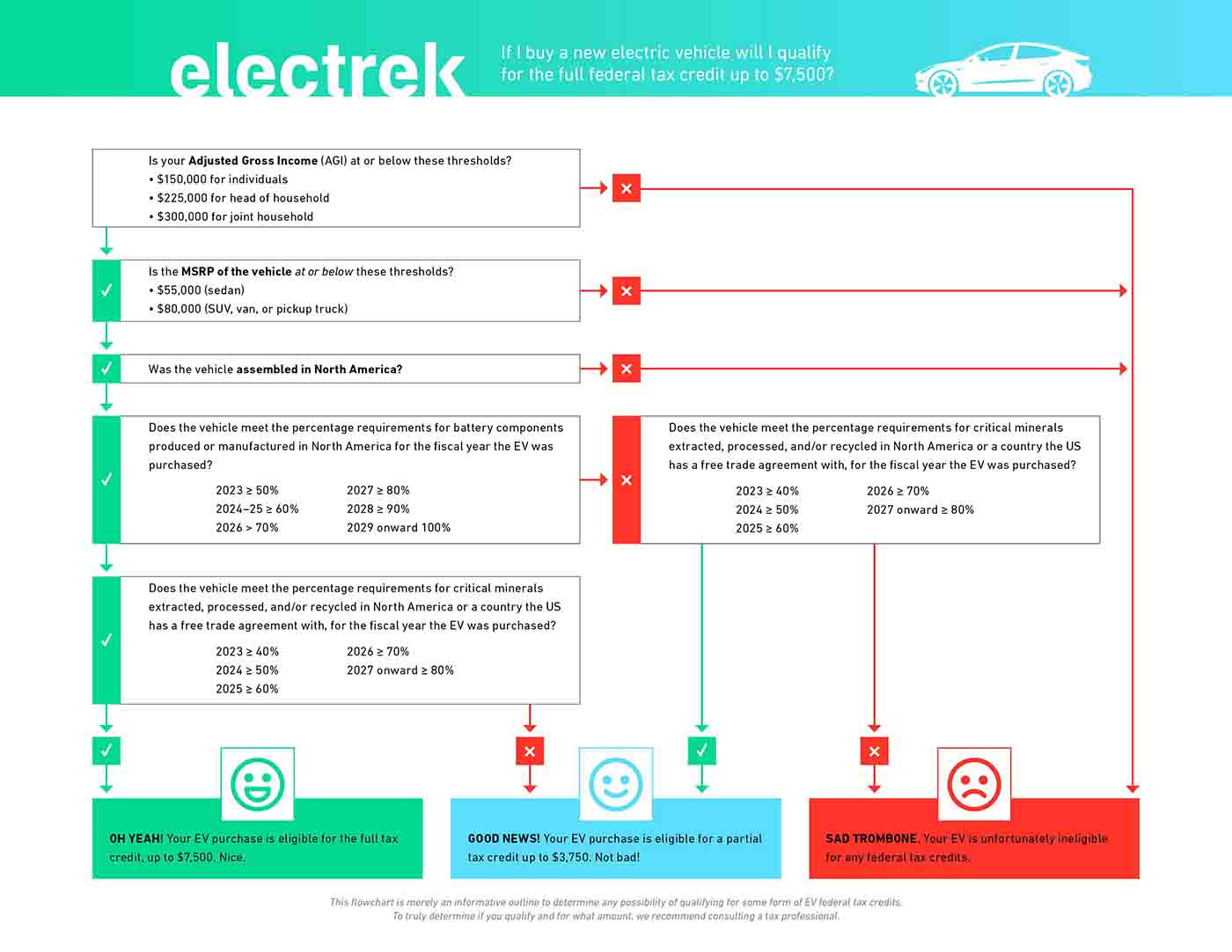

Delve into our comprehensive guide designed to help taxpayers understand the intricacies of the Electric Vehicle (EV) Tax Credit. As EV adoption gains momentum, it’s vital to stay informed about the financial incentives available, such as the federal tax credit, which can save you thousands of dollars. Our detailed guide demystifies the process by outlining the eligibility requirements, credit amount, and necessary documentation. We also provide practical tips on how to maximize your benefits while making an environmentally conscious choice. Stay ahead of the curve by gaining invaluable insights into the EV Tax Credit, and confidently navigate your way through the process with the help of our expert guidance.

Top Factors to Consider When Seeking Expert Tax Advice on Electric Vehicle Incentives

When seeking expert tax advice on electric vehicle (EV) incentives, it’s crucial to consider several factors to ensure the guidance you receive is both accurate and relevant. First, look for a tax professional with a proven track record in handling EV tax credits and incentives. This will ensure they are well-versed in the latest regulations and can provide tailored advice based on your unique situation. Additionally, verify their credentials and certifications to guarantee they possess the necessary expertise. Finally, consider the fees associated with their services, and ensure they are transparent about any potential costs. By keeping these factors in mind, you can confidently navigate the EV tax credit landscape with the help of a knowledgeable tax expert.

How to Maximize Your EV Tax Credit Savings: Tips from Professional Tax Advisors

When looking to maximize your EV tax credit savings, it’s essential to seek professional tax advice from experienced tax advisors. These experts can guide you through the complex process and ensure you’re taking full advantage of the available tax credits. They will help you understand the eligibility criteria, calculate the credit amount, and optimize your tax planning strategy. Additionally, professional tax advisors can assist with the proper documentation and filing deadlines, ultimately maximizing your savings and ensuring compliance with tax laws. Don’t miss out on potential tax benefits—trust the expertise of professional tax advisors to secure your EV tax credit savings.

Navigating the Complexities of EV Tax Credit Regulations with the Help of Tax Professionals

Navigating the complexities of EV tax credit regulations can be a daunting task, especially for individuals unfamiliar with tax laws and policies. Engaging the expertise of tax professionals is crucial to ensure maximum savings and compliance with ever-changing legislation. By seeking professional tax advice, individuals can better understand eligibility requirements, claim procedures, and potential tax benefits associated with electric vehicle ownership. Furthermore, tax experts can provide invaluable guidance on strategies for optimizing tax credits, while staying up-to-date with the latest developments in the EV industry. In conclusion, leveraging the knowledge of tax professionals is an essential step for those looking to make the most of the EV tax credit.

Case Studies: How Expert Tax Advice Has Helped Individuals and Businesses Benefit from the EV Tax Credit

Case Studies: Expert Tax Advice on the EV Tax CreditDiscover how expert tax advice has significantly benefited individuals and businesses in maximizing their EV tax credit benefits. By leveraging professional tax services, they have successfully navigated the complex tax regulations surrounding electric vehicle (EV) tax credits. Our case studies highlight the importance of seeking expert advice to determine eligibility, calculate tax savings, and ensure proper documentation. With the continuous evolution of tax laws, obtaining professional guidance is crucial to stay updated and avoid costly mistakes. Learn from real-life examples and gain insights on how to capitalize on EV tax credits, ultimately driving towards a greener and more financially rewarding future.

GIPHY App Key not set. Please check settings