Are you considering making the switch to an electric vehicle (EV) and want to make the most of the attractive tax incentives available? You’re in the right place! In this comprehensive guide, we’ll walk you through the ins and outs of comparing the EV tax credit for different electric vehicle models. Maximizing your savings has never been easier, thanks to our expert tips and tricks. Read on to discover how you can unlock the full potential of these eco-friendly benefits and drive away in your dream electric car, all while keeping your wallet happy!

Understanding the Basics of the EV Tax Credit: Eligibility Criteria and Benefits

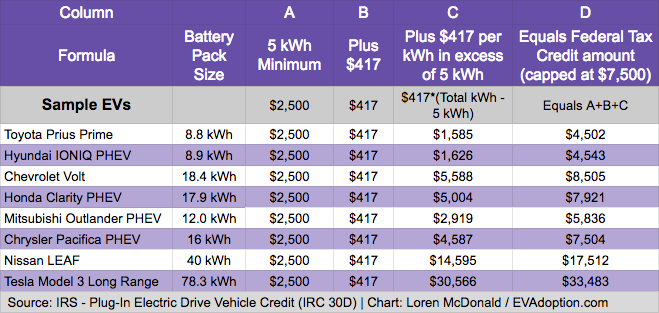

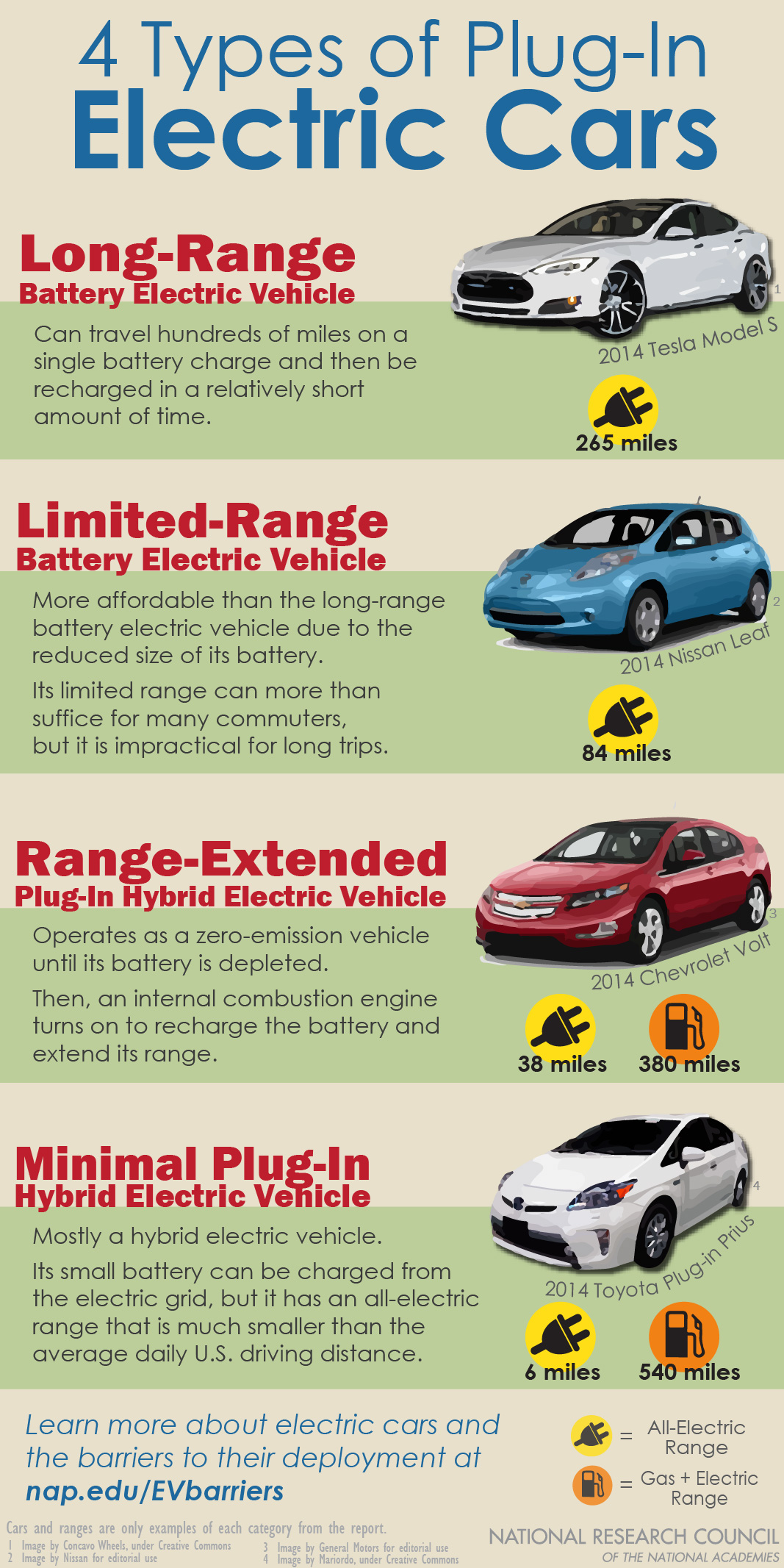

Before diving into the comparison of EV tax credits for various electric vehicle models, it’s essential to comprehend the basics of the EV tax credit, including eligibility criteria and benefits. This federal incentive program encourages the adoption of environmentally-friendly transportation by offering substantial financial advantages to EV buyers. To qualify for the credit, the EV must be new, have a battery capacity of at least 4 kWh, and primarily draw power from an external source. Furthermore, the credit amount varies depending on the vehicle’s battery capacity, ranging from $2,500 to a maximum of $7,500. Understanding these fundamental aspects will empower you to make informed decisions when comparing electric vehicle models and their respective tax credit benefits.

Decoding the Federal EV Tax Credit: How it Varies for Different Electric Vehicle Models

Decoding the Federal EV Tax Credit can be a crucial step in determining the best electric vehicle model for your needs. The amount of tax credit available varies based on the vehicle’s battery capacity, manufacturer, and the total number of electric vehicles sold by the manufacturer. Understanding these factors can help you make an informed decision and potentially save thousands of dollars on your next electric vehicle purchase. To compare the tax credit for different electric vehicle models, you’ll need to research each model’s battery capacity, the manufacturer’s sales figures, and the current status of the tax credit. By doing so, you can effectively compare the potential savings and make an educated choice on the most suitable electric vehicle for your lifestyle.

Maximizing Your Savings: Top Tips for Comparing EV Tax Credits Across Various Models

When searching for the perfect electric vehicle (EV) to suit your needs, it’s crucial to consider the potential savings offered by various EV tax credits. To maximize your savings, start by researching eligible models that qualify for federal and state tax incentives. Compare the credit amounts, as they can differ significantly between models and manufacturers. Check for additional local rebates and incentives, such as reduced registration fees or utility discounts, to further boost your savings. Keep in mind that tax credits may phase out as manufacturers reach sales milestones, so staying up-to-date on the latest information ensures you’re making the most cost-effective decision when purchasing your eco-friendly ride.

Dissecting the State-wise Incentives: How to Factor in Local EV Tax Credits and Rebates

In this blog section, we delve into the various state-wise incentives that impact the overall cost of electric vehicles. It’s important to consider the local EV tax credits and rebates, as they can significantly influence your final purchasing decision. To make the most of these incentives, research the specific programs available in your state, as the benefits can vary greatly. Some states offer substantial cash rebates, while others provide non-monetary perks like access to carpool lanes or reduced registration fees. By factoring in these incentives, you can better compare the affordability of different electric vehicle models and ultimately choose the one that offers the best value.

EV Tax Credit Expiration: What to Know About the Phase-Out Period and its Impact on Your Electric Vehicle Purchase

As you research electric vehicles (EVs), it’s essential to understand the EV tax credit expiration and its impact on your potential purchase. The federal tax credit for EVs begins to phase out once a manufacturer sells 200,000 qualified vehicles. During the phase-out period, credits are reduced by 50% for six months, followed by a further reduction to 25% for another six months, before ultimately expiring. To maximize your savings, it’s crucial to stay informed about the current phase-out status of the specific EV model you’re considering. Timely purchases can yield significant tax benefits, making your transition to a greener vehicle more cost-effective.

GIPHY App Key not set. Please check settings