Are you considering joining the electric vehicle revolution? If so, you’re in for a treat! Not only do electric vehicles (EVs) contribute to a cleaner environment, but they can also save you some serious cash, thanks to the EV tax credit. In this comprehensive guide, we will explore how to effectively use the EV tax credit to encourage electric vehicle adoption, ensuring you get the most bang for your buck. So buckle up, and let’s dive into the world of EV incentives, benefits, and everything you need to know to make the switch to a greener mode of transportation.

Understanding the EV Tax Credit: The Key to Promoting Electric Vehicle Adoption

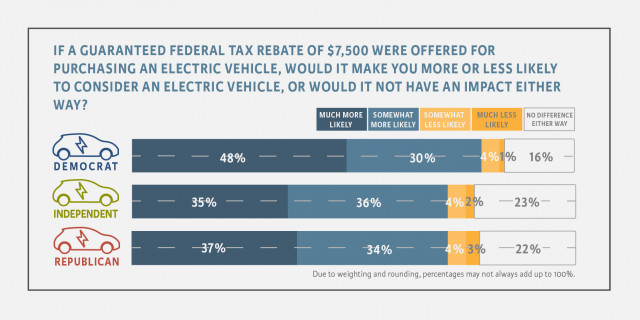

Understanding the EV Tax Credit is crucial for promoting electric vehicle adoption and making the transition to a greener future. This federal incentive provides a tax credit of up to $7,500 for eligible electric vehicles, making them more affordable and appealing to potential buyers. By comprehending how this tax credit works and how it can benefit consumers, you can effectively encourage electric vehicle adoption within your community. Stay informed about the specific eligibility requirements and how the credit is applied, as this knowledge can greatly impact your decision to invest in an eco-friendly vehicle. Leverage the EV Tax Credit to contribute to a more sustainable environment and enjoy the benefits of driving an electric vehicle.

Maximize Your Savings: Utilizing the EV Tax Credit for a Greener Future

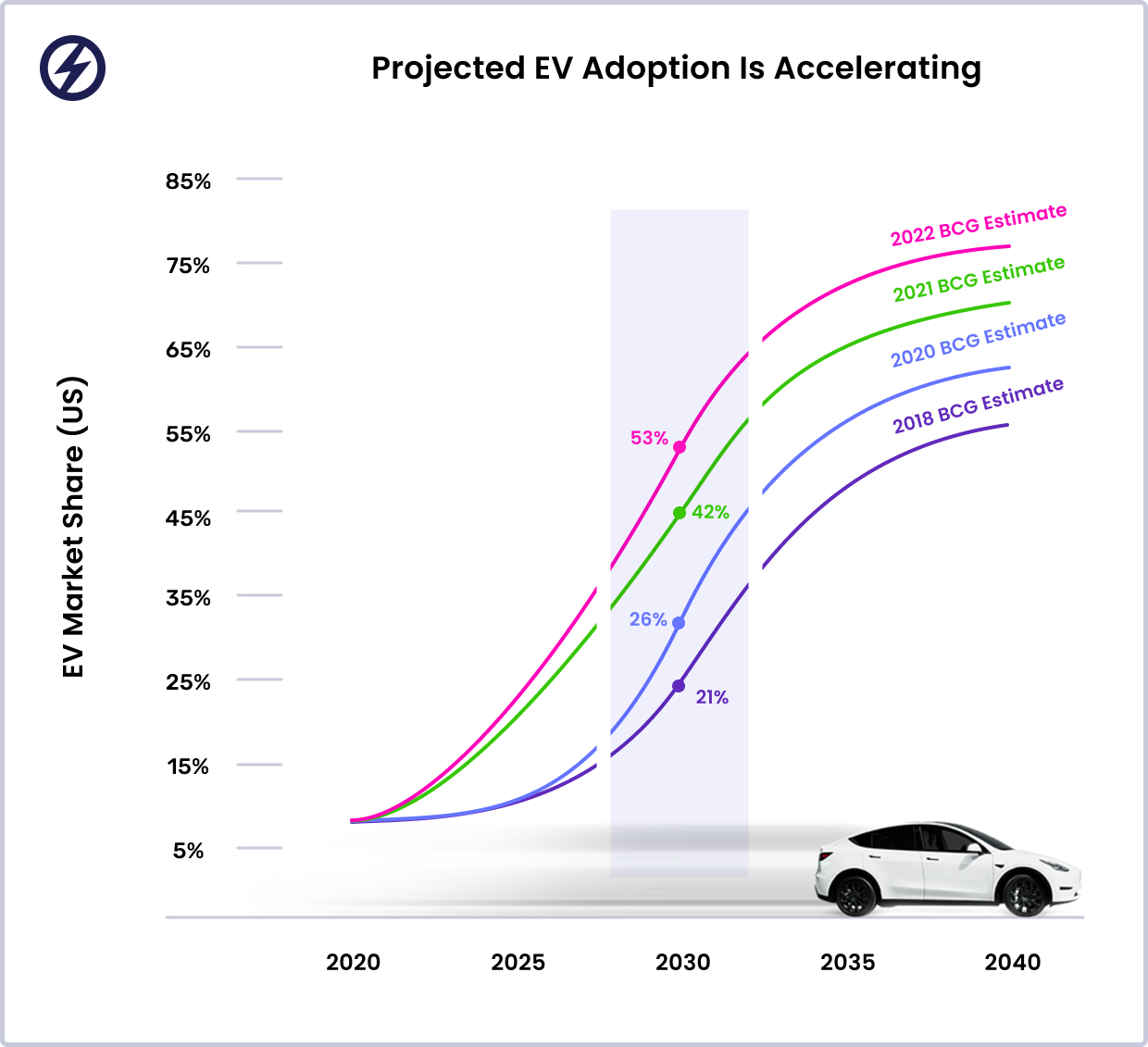

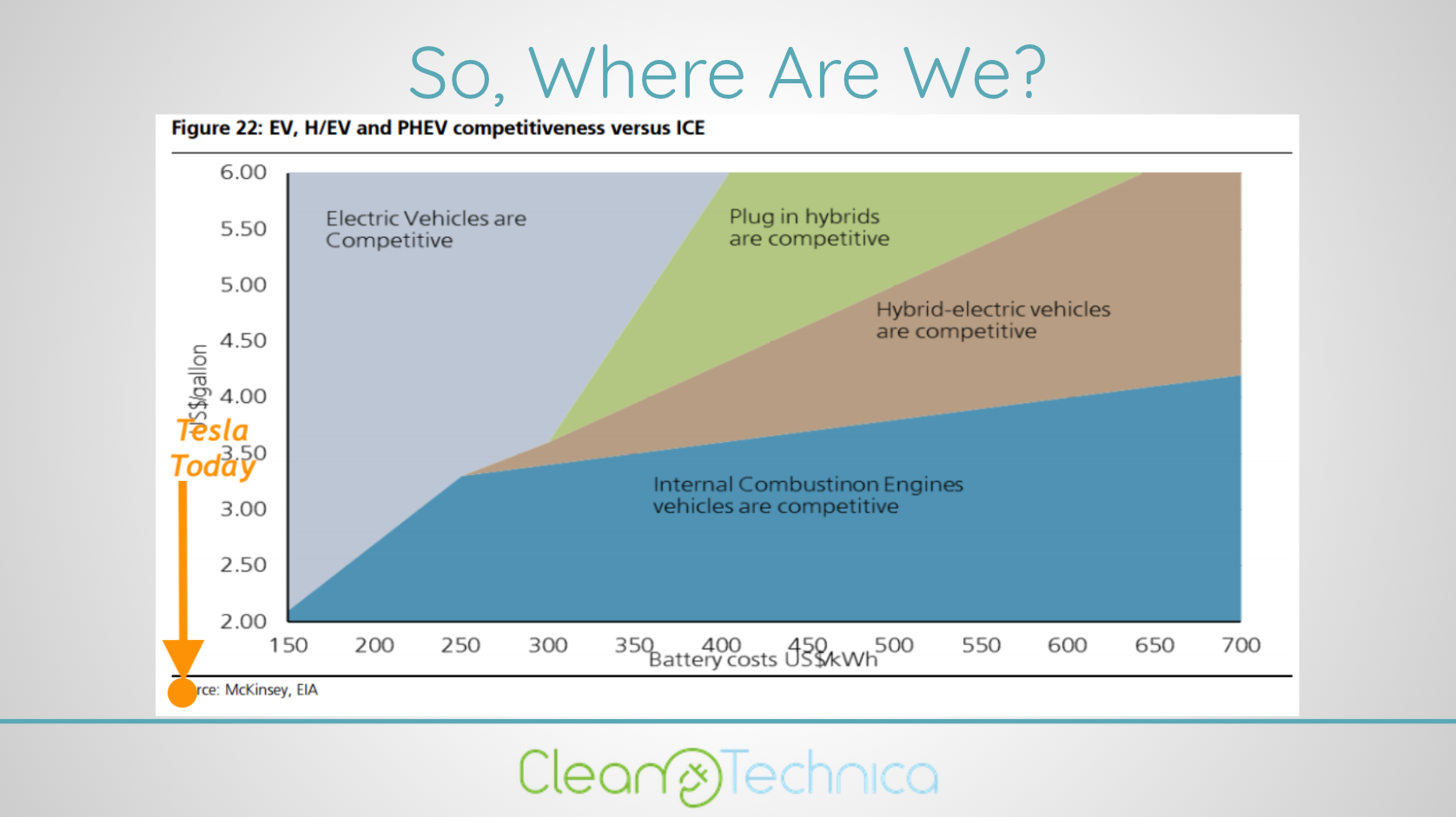

Maximize your savings and contribute to a greener future by taking full advantage of the EV tax credit when purchasing an electric vehicle. By doing so, you not only reduce your carbon footprint but also enjoy significant financial benefits. To optimize your savings, research the various EV models eligible for the tax credit and compare their features to find the perfect fit for your needs. Keep in mind that the credit amount varies depending on battery capacity, with higher credits going to vehicles with larger batteries. Additionally, stay updated on any changes to the tax credit program, as it may evolve over time to further incentivize electric vehicle adoption. Embrace the eco-friendly revolution and drive towards a sustainable future with electric vehicles and the EV tax credit.

Exploring the Benefits: How the EV Tax Credit Drives Sustainable Transportation Choices

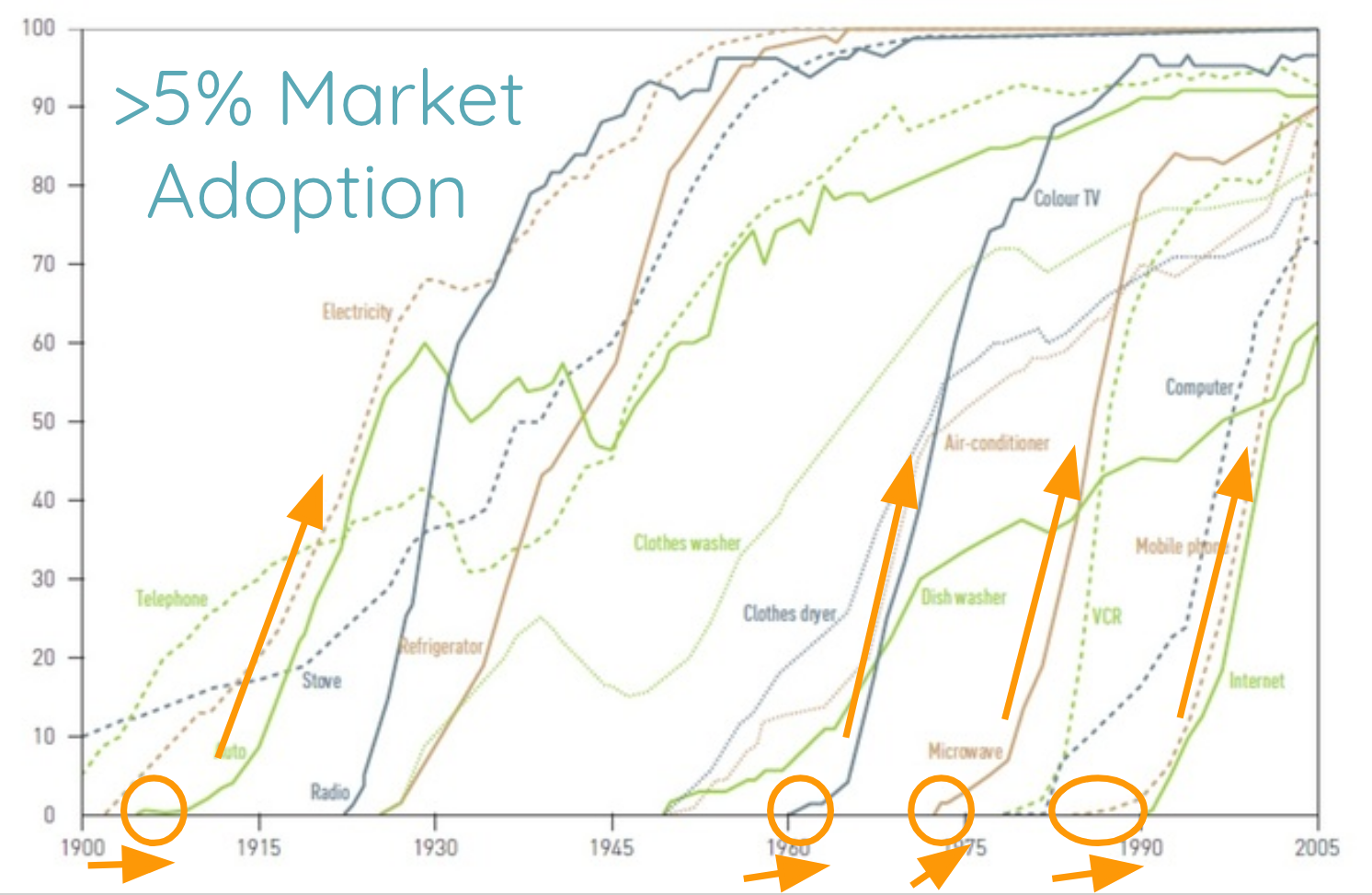

Delve into the advantages of the EV tax credit as a catalyst for sustainable transportation choices, and uncover how it can significantly impact the environment and your wallet. This incentive not only makes electric vehicles more accessible, but also encourages individuals to adopt an eco-friendly lifestyle. By taking advantage of the EV tax credit, you are actively contributing to the reduction of greenhouse gas emissions, promoting energy efficiency, and supporting the growth of the electric vehicle industry. Discover the long-term benefits of this green initiative and learn how you can play a crucial role in fostering a more sustainable future.

Navigating the EV Market: Strategies to Leverage the EV Tax Credit for Increased Adoption

Navigating the electric vehicle (EV) market can be a daunting task, but with the right strategies, the EV tax credit can significantly boost adoption rates. Firstly, it’s essential to research and identify the eligible EV models that suit your needs and preferences. Next, consider the long-term savings and environmental benefits of driving an electric car, as well as the lower maintenance costs. Finally, consult with a tax professional to fully understand and maximize the available EV tax incentives. By leveraging these strategies, potential EV buyers can confidently make an informed decision and contribute to the global shift towards sustainable transportation.

Charging Ahead: How the EV Tax Credit Supports a Cleaner, Greener Automotive Industry

Charging Ahead: The EV Tax Credit is a powerful tool in driving the transition towards a cleaner, greener automotive industry. By providing financial incentives, this policy encourages consumers to adopt electric vehicles (EVs), which in turn helps to reduce greenhouse gas emissions and improve air quality. With the increasing availability of charging infrastructure, greater range capabilities, and a wider variety of EV models, consumers now have more reasons than ever to make the switch. Furthermore, the growth of the EV market stimulates innovation, job creation, and economic development, demonstrating that sustainability and prosperity can go hand-in-hand. By leveraging the EV Tax Credit, we can accelerate the shift towards a more sustainable transportation future.

GIPHY App Key not set. Please check settings