There are a lot of great credit cards out there, but which one is the best for you? In this article, we’ll take a look at the 10 best credit cards in the United States, based on factors such as rewards programs, APR, and fees.

So whether you’re looking to build your credit score or just get the best deal available, read on!

Which are the best credit cards in America?

OpenSky Secured Visa Credit Card

If you’re looking for a safe and secure way to borrow money, OpenSky Secured Visa Credit Card is the best credit card for you. This card offers great features, including secured borrowing and fraud protection.

OpenSky Secured Visa Credit Card also has a low APR*, which means you’ll only be charged interest on your loan from day one. Plus, there are no annual fees or hidden charges. In addition, this card offers a 100% deposit guarantee, so you can rest assured that your money will be available when you need it.

Overall, OpenSky Secured Visa Credit Card is the perfect credit card for people who want to borrow money safely and securely. Thanks to its great features, it’s also the perfect choice for people who want the best possible credit rating. So don’t wait any longer – apply today!

Citi Simplicity Card

If you’re looking for a credit card that offers a low-interest rate and generous rewards, the Citi Simplicity Card may be the perfect option for you.

This card has no annual fee and offers an introductory 0% APR on purchases and balance transfers for the first six months. After that, the APR is 14.99%. Plus, you’ll earn 3 points per dollar spent on all your transactions, which can be redeemed for rewards like cash back, travel rewards, or merchandise. You can even use your points to pay your bills! The Citi Simplicity Card is one of the best credit cards in the US because it has a low-interest rate and generous rewards.

Ink Business Preferred Credit Card

One of the best credit cards in the US is the Ink Business Preferred Credit Card. This card offers great rewards and a low annual fee. It also has a strong safety rating from the Better Business Bureau (BBB).

The Ink Business Preferred Credit Card offers excellent rewards for both business and personal use. You can earn rewards on purchases made at participating merchants, including restaurants, home goods stores, and more. You also receive 3% cash back on all other purchases, which makes it a great option for everyday spending. The card has a 0% introductory APR for 18 months, so you can get started right away and benefit from great rates.

The Ink Business Preferred Credit Card also has a low annual fee of $99. This makes it one of the cheapest credit cards available, and it has a strong safety rating from the BBB. You can be sure that you’re getting a high-quality card with the Ink Business Preferred Credit Card.

Gold Delta SkyMiles Credit Card from American Express

One of the best credit cards in the US is the Gold Delta SkyMiles Credit Card from American Express. This card has a number of great features that make it a great option for consumers. First and foremost, the card offers a sign-up bonus of 50,000 miles when you spend $1,000 in the first three months. This is a great way to get started with your credit card journey, and it will help you build up your credit history.

The Gold Delta SkyMiles Credit Card also has low-interest rates, which makes it an affordable option for consumers. The interest rate is currently at 0%. Additionally, the card has a generous return policy that allows consumers to earn rewards on every purchase they make. This means that you can save money on your groceries, clothes, and more.

If you are looking for a great credit card that offers a lot of benefits, the Gold Delta SkyMiles Credit Card from American Express is a great option.

Chase Sapphire Reserve Credit Card

The Chase Sapphire Reserve Credit Card is one of the best options when it comes to credit cards. This card has a high rewards rate and a great customer service team. It also comes with some great safety features, like fraud protection and travel insurance.

One of the main reasons why the Chase Sapphire Reserve Credit Card is so good is its rewards rate. The card offers a 1% cash back on all purchases, which makes it one of the highest rewards rates available. In addition, the card also has a sign-up bonus of 50,000 points if you spend $4,000 in the first three months. This means that you can receive a $625 value in rewards simply by signing up for the card and spending some money!

Another great feature of the Chase Sapphire Reserve Credit Card is its fraud protection. This protection includes fraud monitoring and 24/7 customer support. If you experience any fraud while using the card, Chase will help you get your money back quickly.

Overall, the Chase Sapphire Reserve Credit Card is one of the best options when it comes to credit cards. Its high rewards rate and great customer service make it a great choice for anyone looking for a good credit card option.

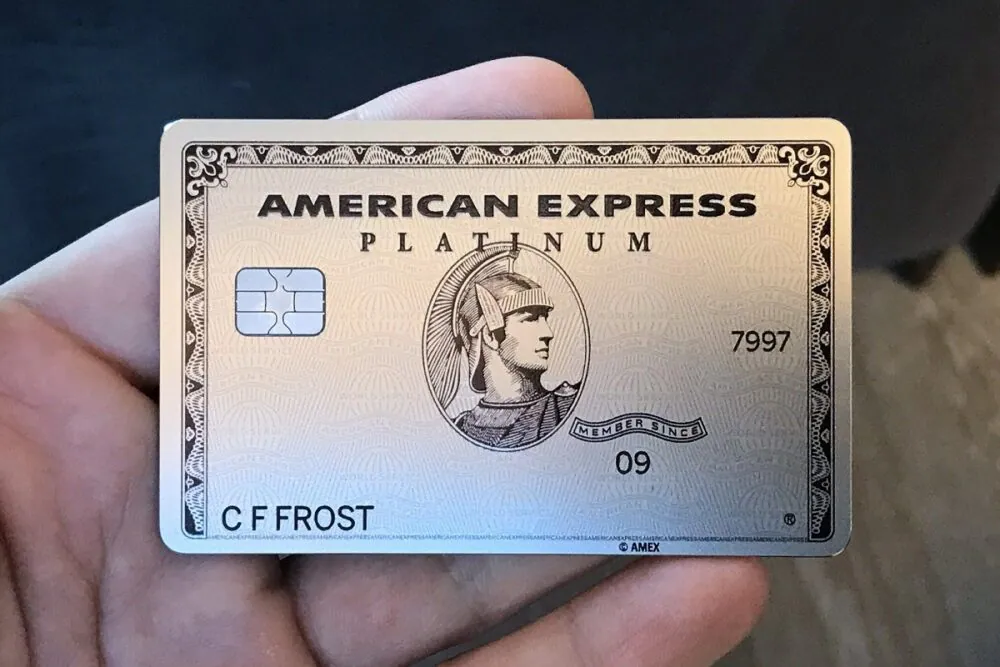

The Platinum Card from American Express

If you’re looking for the best credit card in the United States, look no further than the Platinum Card from American Express. This card offers great benefits, including access to exclusive deals and discounts.

The Platinum Card from American Express has an annual fee of $450, but it’s well worth it for the amazing benefits it offers. For example, you can use the card to purchase tickets to events and concerts without having to pay additional fees. You also get access to a wide range of luxury services, such as concierge service and travel assistance.

If you’re looking for a card that offers great rewards and benefits, the Platinum Card from American Express is definitely worth considering.

Capital One Venture Rewards Credit Card

The Capital One Venture Rewards Credit Card is the best credit card for people who are looking for a card with a high rewards rate.

This card offers 2x miles on all purchases and 1x miles on all travel-related spending, which makes it a great choice for people who travel frequently. The card also has an annual fee of $0, which makes it one of the most affordable credit cards available.

Additionally, the card has no foreign transaction fees, which makes it a great choice for people who frequently travel outside the US. The Capital One Venture Rewards Credit Card is one of the most popular credit cards in the US and is definitely worth considering if you’re looking for a high-quality credit card that offers great rewards rates and no annual fees.

American Express Gold Card

American Express is a well-known and trusted credit card company. They offer a variety of cards that can be used in different ways. One of the best cards they offer is the American Express Gold Card.

The American Express Gold Card offers a number of benefits that make it a desirable card to have. These benefits include:

- Free flights and travel insurance: The American Express Gold Card offers free travel insurance, which can be useful if something happens while you’re traveling. This insurance can cover things like lost luggage, cancellations, and more.

- No annual fees: The American Express Gold Card doesn’t have any annual fees, which makes it a great option if you want to use it for everyday expenses like groceries or bills.

- Easy to use: The American Express Gold Card is easy to use and has an intuitive user interface. This means that you won’t have any trouble using it for your everyday expenses.

If you’re looking for a credit card that offers great benefits and doesn’t have any annual fees, the American Express Gold Card is a great option.

Blue Cash Preferred from American Express

One of the best credit cards to use in the US is the Blue Cash Preferred from American Express. This card has many great benefits, including rewards for spending and a low-interest rate.

The Blue Cash Preferred from American Express offers a rewards program that is unique compared to other cards. You earn rewards based on how much you spend, not on the amount of debt you have. This means that you can earn rewards even if you have a large balance on your card.

In addition, the interest rate on this card is very low, which makes it a great option for people who are looking for a card that will help them improve their finances.

The Blue Cash Preferred from American Express also has some great features that make it a great choice for people who want to protect their money. For example, the card has fraud protection and accidental damage protection. These protections help to keep your money safe while you are using the card and help to reduce your risk of financial losses.

Chase Sapphire Preferred Card

Chase Sapphire Preferred card is one of the best credit cards in the US. It has a high rewards rate, great customer service, and a low annual fee.

One of the best features of the Chase Sapphire Preferred card is its high rewards rate. This card offers a 1% on all purchases, which is higher than most other credit cards.

The rewards rate on this card can be increased by earning bonus points. Additionally, you can also earn points for referring your friends to the Chase Sapphire Preferred card. This card also has a 0% intro APR for 12 months on purchases and balance transfers, which is great for getting your debt obligations off your balance quickly. In addition, there is no annual fee for this card.

The Chase Sapphire Preferred card also has excellent customer service. If you have any questions or problems with your account, Chase will be able to help you. You can also call customer service 24/7, and they will be able to resolve any issues that you may have.

The Chase Sapphire Preferred card has a low annual fee of $95 per year. This makes it one of the best credit cards in terms of cost-effective benefits. Overall, the Chase Sapphire Preferred card is an excellent

Bottom Line

There are a lot of great credit cards out there, but which one is the best for you? To help you decide, we’ve put together some key insights about the best credit cards in the US.

First, it’s important to consider your spending habits. Some cards are better for people who spend a lot on their regular bills, like rent or groceries. Other cards are better for people who spend more on leisure activities, like going out to restaurants or buying items online.

Second, it’s important to make sure that the card you choose has good reward features. Many cards offer great discounts on things like travel and dining. Plus, many cards also offer special perks like free hotel rooms and freebies when you make a purchase.

Third, it’s important to consider your credit score. A high credit score means that you’re a low-risk borrower and that the card company is likely to approve you for a card with good rewards features. A low credit score means that you’re a higher-risk borrower and that the card company may not approve you for a card with good rewards features.

GIPHY App Key not set. Please check settings