Are you considering going green and embracing the electric vehicle (EV) revolution? If so, you’ll be thrilled to know that the government is offering enticing EV tax credits as a reward for your eco-friendly choice! But navigating the world of EV tax credits can be complex and daunting. Fear not, as we’re here to help! In this comprehensive guide, we’ll provide you with valuable resources and tools to better understand and maximize your savings with the EV tax credit. Get ready to rev up your knowledge and accelerate your journey towards more sustainable transportation, all while keeping your wallet happy.

Navigating the Complex World of Electric Vehicle Tax Credits: Tips and Tricks for Maximizing Your Benefits

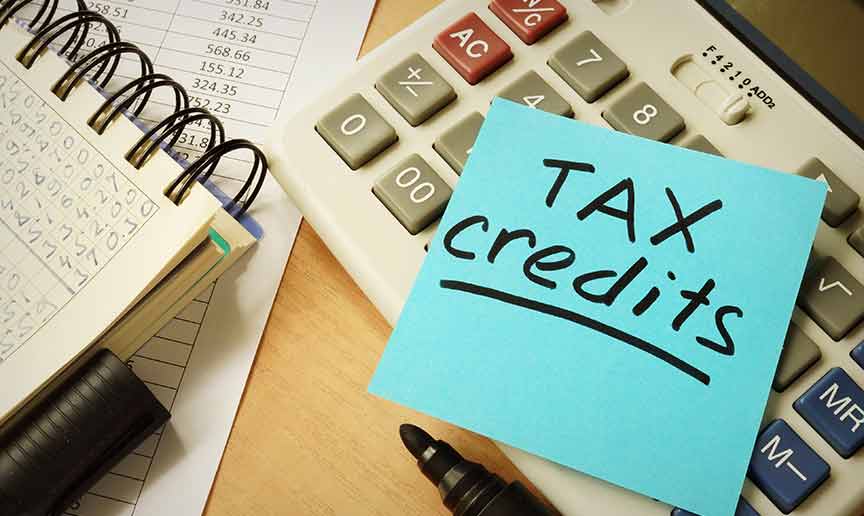

Navigating the complex world of electric vehicle (EV) tax credits can be overwhelming, but with the right tips and tricks, you can maximize your benefits and save thousands on your EV purchase. Start by understanding the federal tax credit program and how it applies to your specific EV model. Research your state’s incentives, as they can significantly boost your savings. Keep an eye on EV manufacturers’ sales figures, as tax credits phase out once a manufacturer reaches 200,000 sold units. Finally, consult a tax professional to ensure you’re taking full advantage of the available tax credits and rebates. By staying informed and proactive, you can make the most of the financial incentives designed to promote the adoption of eco-friendly electric vehicles.

The Ultimate Guide to Understanding and Utilizing EV Tax Credits: Essential Resources for Every Electric Car Owner

In The Ultimate Guide to Understanding and Utilizing EV Tax Credits, we provide essential resources for every electric car owner to navigate the world of EV tax credits seamlessly. As the popularity of electric vehicles continues to surge, it’s crucial to stay informed about the incentives available to make your EV ownership experience even better. Our comprehensive guide covers everything from the basics of EV tax credits, eligibility criteria, and the application process, to maximizing your savings and staying updated on the latest changes in tax laws. Explore our meticulously curated resources and tools to make the most of the EV tax credit benefits and contribute to a greener future.

From Eligibility to Claiming: Your Comprehensive Guide to the EV Tax Credit and Incentives

Dive into our comprehensive guide on the EV Tax Credit and incentives, designed to empower you with essential information and resources for a seamless experience. From understanding eligibility criteria to successfully claiming your benefits, we’ve got you covered. Learn about the latest updates in federal tax credits, state-specific incentives, and other financial opportunities available to electric vehicle owners. Our SEO-optimized content will help you navigate the fast-paced world of EVs, ensuring you make informed decisions and maximize your savings. Don’t miss out on the numerous advantages of going green – explore our guide today and embrace the future of sustainable transportation!

Unlock the Full Potential of EV Tax Credits: Top Online Resources and Expert Advice for a Seamless Application Process

Unlock the full potential of EV tax credits by leveraging top online resources and expert advice for a seamless application process. Start by visiting the U.S. Department of Energy’s website, which offers comprehensive information on federal incentives, eligibility criteria, and FAQs on the tax credit. Additionally, consult a tax professional or the IRS website for guidance on Form 8936 and other relevant documentation. Stay updated with the latest news on EV tax credits, legislation, and industry trends by subscribing to reputable blogs and newsletters like Green Car Reports and Plug-In America. By utilizing these resources, you’ll be well-prepared to maximize your savings and enjoy a smooth EV tax credit experience.

Demystifying the EV Tax Credit: How to Successfully Access Incentives and Boost Your Electric Vehicle Ownership Experience

Demystifying the EV Tax Credit is a crucial step in enhancing your electric vehicle ownership experience. By comprehending the ins and outs of this financial incentive, you can effectively access the resources and tools required to maximize your savings. Delve into the eligibility criteria, application process, and the state-specific incentives to ensure a seamless transition to sustainable transportation. Stay informed, and leverage online platforms, government websites, and consultation services to decode the complexities of the EV Tax Credit. With a well-rounded understanding, you can confidently navigate the world of electric vehicles and contribute to a greener future.

GIPHY App Key not set. Please check settings