Discover the intriguing world of electric vehicles (EVs) and their resale value as we delve into the impact of the coveted EV tax credit. This comprehensive guide will help you navigate the ever-evolving landscape of electric cars, decrypting the crucial factors that influence their resale value. Unearth the hidden gems of the EV market and learn how the government’s incentive program can affect your return on investment. Join us in this electrifying journey to better understand and maximize the benefits of the green revolution in the automotive industry!

Understanding the EV Tax Credit: A Comprehensive Overview for Potential Electric Vehicle Owners

Delving into the world of electric vehicles (EVs) can be exhilarating, but for potential owners, it’s crucial to grasp the ins and outs of the EV tax credit before making a purchase. This influential financial incentive, implemented by the government, aims to boost the adoption of eco-friendly transportation by offering substantial tax rebates on eligible EVs. Comprehending the eligibility criteria, credit amount, and application process can significantly impact your decision-making and help you maximize the benefits of owning an electric car. In this comprehensive overview, we will explore the key aspects of the EV tax credit, equipping you with essential knowledge to assess its effect on electric vehicle resale value.

The Role of the Federal EV Tax Credit in Influencing Electric Vehicle Resale Value: Key Factors to Consider

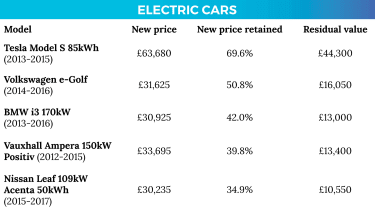

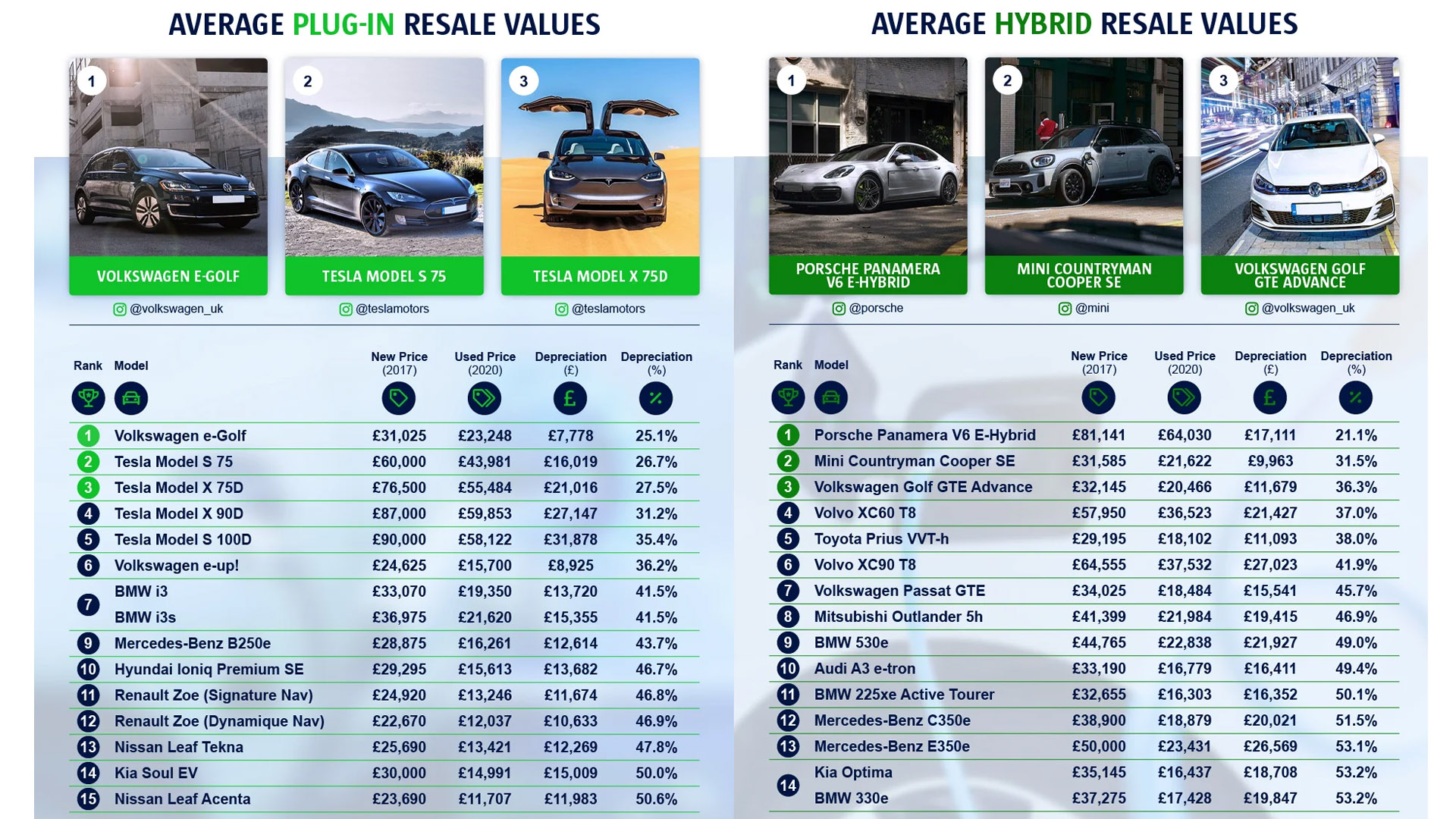

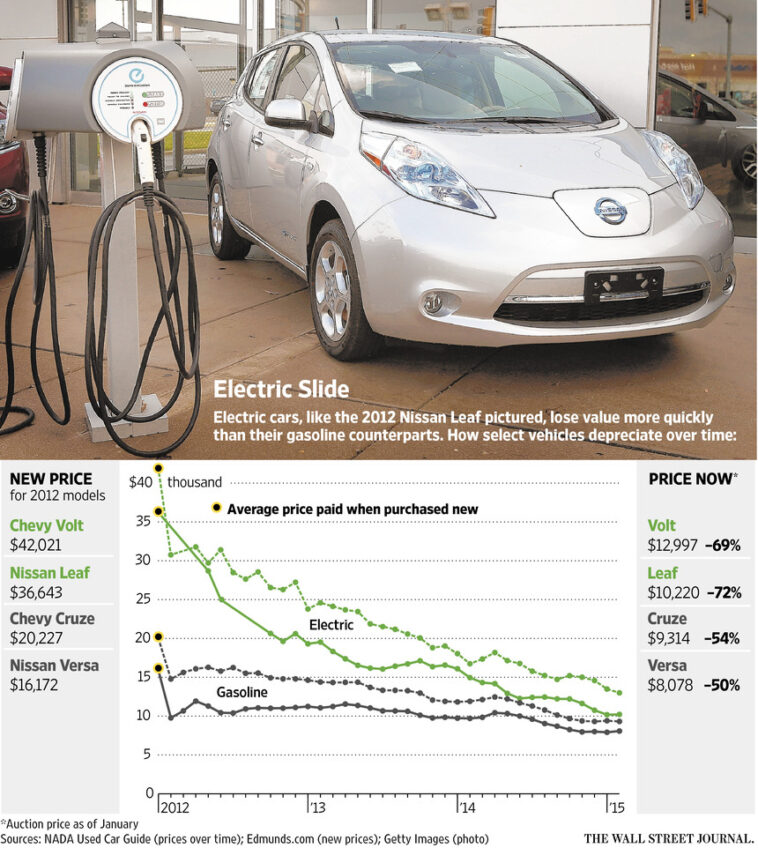

The Federal EV Tax Credit plays a significant role in shaping the electric vehicle (EV) resale market by offering substantial financial incentives to prospective buyers. When considering the impact of this tax credit on resale value, it’s essential to examine key factors such as the credit’s eligibility criteria, varying credit amounts, potential phase-out periods, and the effect on consumer demand. By understanding these crucial aspects, one can better assess how the EV Tax Credit ultimately influences the depreciation rates and resale value of electric vehicles, providing valuable insights for both buyers and sellers in the competitive EV market.

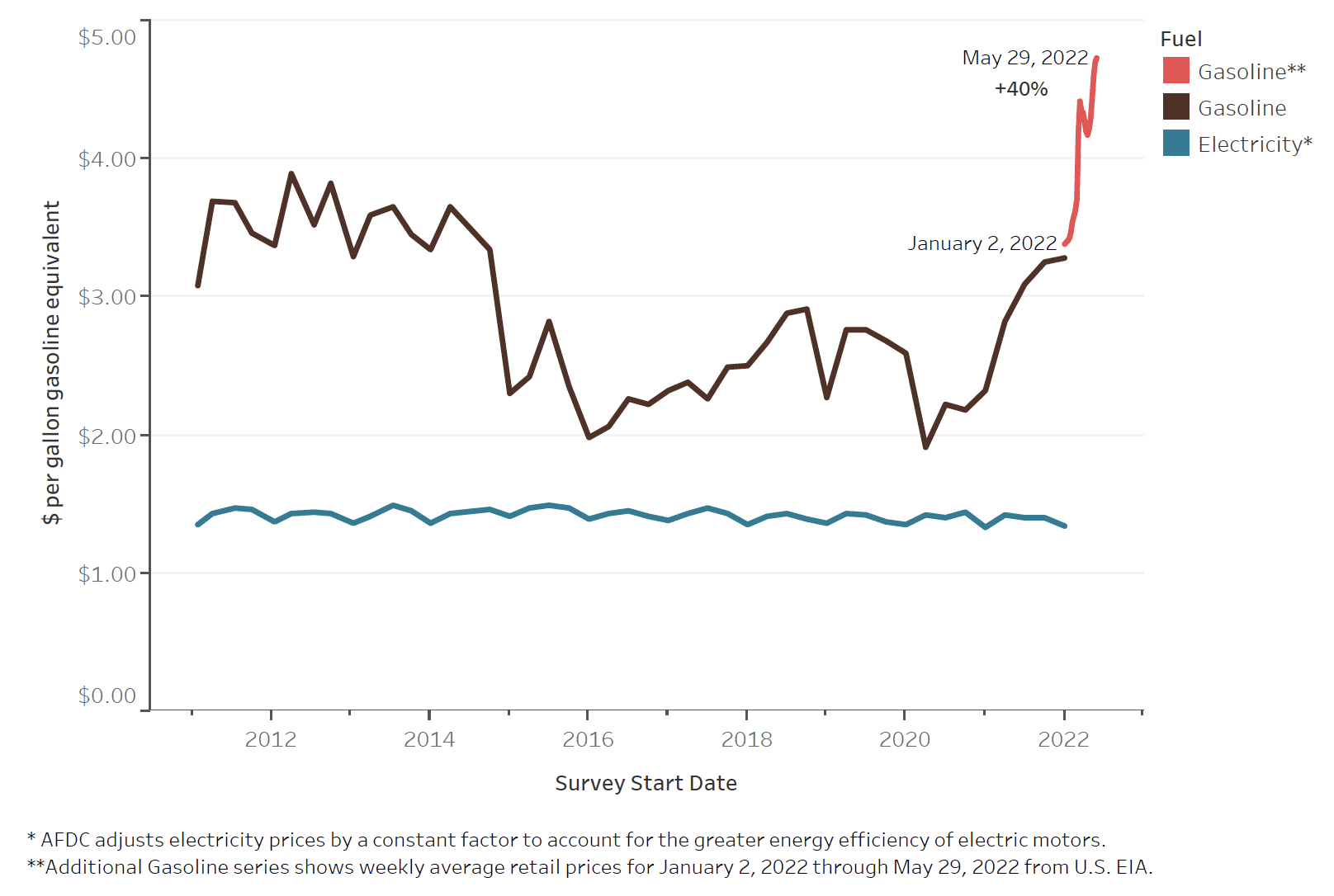

Exploring the Correlation between EV Tax Incentives and Long-term Resale Value of Electric Cars

When examining the link between EV tax incentives and the long-term resale value of electric vehicles, it’s crucial to consider various factors that may influence this relationship. The availability of tax credits and rebates for purchasing an electric car can significantly reduce the upfront cost, making them more appealing to potential buyers. As a result, this increased demand can lead to higher resale values for EVs over time. Furthermore, as the market shifts towards sustainable transportation options, the depreciation rate of electric vehicles may decrease, further boosting their resale value. In this blog section, we will delve into the correlation between EV tax incentives and the long-term resale value of electric cars, providing insights for both buyers and sellers in the evolving electric vehicle market.

How to Accurately Estimate Your Electric Vehicle’s Resale Value Considering the Impact of Tax Credits

To accurately estimate your electric vehicle’s resale value while factoring in the impact of tax credits, it’s crucial to stay informed on current market trends and incentives. Conduct thorough research on the specific make and model, taking note of any applicable federal or state EV tax credits that may have been applied at the time of purchase. Utilize online resources, such as Kelley Blue Book or Edmunds, to compare resale values of similar vehicles in your area. Additionally, consider factors like vehicle condition, mileage, and any potential technological advancements that may affect demand. By staying up-to-date on the EV market and understanding the role tax credits play, you’ll be well-equipped to determine your electric vehicle’s true resale value.

Maximizing Your Electric Vehicle Investment: Expert Tips on Navigating the EV Tax Credit and Resale Value Landscape

To maximize your electric vehicle (EV) investment, it’s crucial to navigate the EV tax credit and resale value landscape effectively. Stay informed on the latest federal and state tax incentives available for purchasing an electric car. These tax credits can significantly lower your upfront costs and improve your overall return on investment. Additionally, consider factors that influence EV resale value, such as battery life, charging infrastructure, and technological advancements in the market. By conducting thorough research, comparing models, and timing your purchase strategically, you can optimize the financial benefits of owning an electric vehicle while contributing to a greener future.

GIPHY App Key not set. Please check settings