Are you considering purchasing an electric vehicle (EV) but feeling overwhelmed by the financial implications? You’re not alone! One critical aspect to consider is the EV tax credit and its impact on vehicle depreciation. In this comprehensive guide, we’ll demystify the process and walk you through the essential steps to accurately factor in the EV tax credit when calculating your eco-friendly car’s depreciation. Get ready to make an informed decision and maximize your investment in a greener future, while also enjoying significant savings on your taxes.

Understanding the EV Tax Credit: An Overview of the Federal Incentive Program

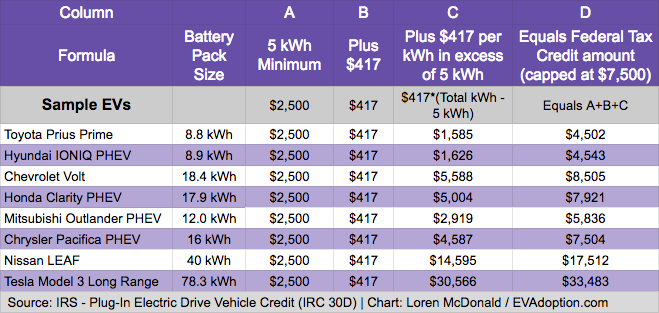

Understanding the EV Tax Credit is crucial when calculating vehicle depreciation, as it helps to offset the initial cost of purchasing an electric vehicle (EV). The Federal Incentive Program, established to encourage the adoption of eco-friendly transportation, offers a tax credit of up to $7,500 for eligible new EVs. This attractive incentive varies depending on the vehicle’s battery capacity and the purchaser’s tax liability. As a buyer, it’s essential to research the specific tax credit available for the EV model you’re considering and incorporate this amount into your depreciation calculations. By doing so, you’ll gain a more accurate understanding of the true ownership cost and potential resale value of your electric vehicle.

Calculating Vehicle Depreciation: A Comprehensive Guide for Electric Vehicle Owners

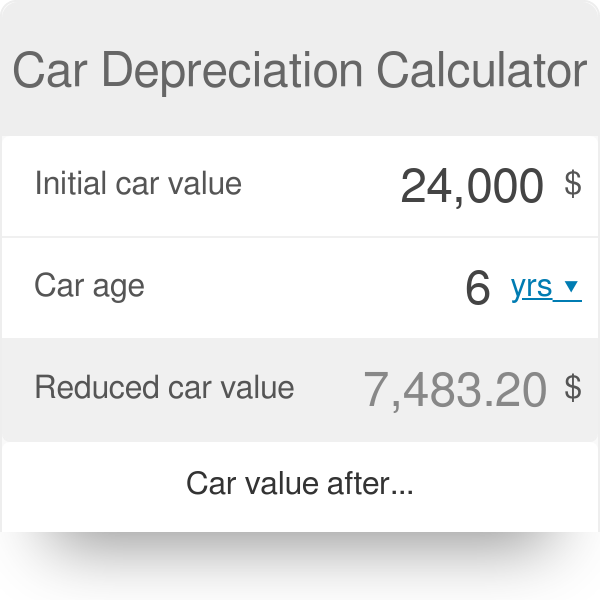

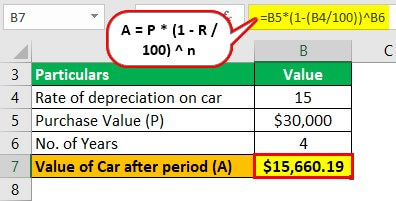

When calculating vehicle depreciation for electric vehicles (EVs), it’s essential to consider the impact of the EV tax credit on your vehicle’s value. This comprehensive guide for EV owners will walk you through the depreciation process, including how to factor in the tax credit, accurately estimate your vehicle’s worth, and ultimately make informed decisions when it comes to selling or trading in your EV. By understanding the intricacies of EV depreciation, you’ll be better positioned to maximize your return on investment, fully utilize government incentives, and navigate the ever-evolving landscape of electric car ownership. Stay ahead of the game by learning how to accurately calculate your EV’s depreciation today.

The Impact of EV Tax Credit on Resale Value: What You Need to Know

The EV tax credit can significantly impact the resale value of your electric vehicle, making it essential to understand its implications when calculating depreciation. With federal tax credits ranging from $2,500 to $7,500, electric car buyers can benefit from substantial savings. However, these credits are gradually phased out once an automaker sells 200,000 qualifying vehicles. As a result, EVs with tax credits may have a higher initial cost, leading to higher depreciation rates over time. Awareness of the tax credit’s impact on your vehicle’s resale value is crucial for accurate financial planning, ensuring you get the best return on your eco-friendly investment.

Maximizing Your Electric Vehicle Investment: Tips for Factoring in the EV Tax Credit

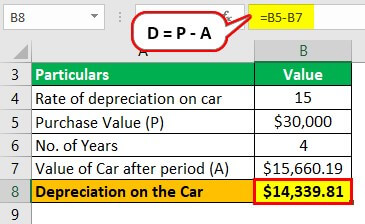

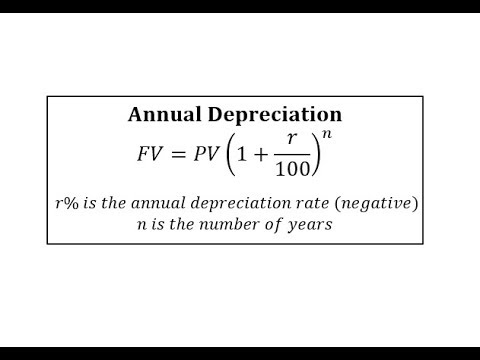

Maximizing your electric vehicle investment is essential to getting the most value out of your purchase, and the EV tax credit plays a significant role in this equation. When considering the depreciation of your vehicle, it’s important to account for the tax credit, as it can substantially impact your total cost of ownership. To accurately calculate vehicle depreciation, start by deducting the tax credit from the initial purchase price, effectively lowering your initial investment. This adjusted price will provide a more realistic representation of your vehicle’s overall depreciation rate. By incorporating the EV tax credit into your calculations, you’ll better understand the true value of your electric vehicle and make smarter decisions for your long-term investment.

Beyond the EV Tax Credit: Exploring Additional Incentives and Benefits for Electric Vehicle Owners

In addition to the EV tax credit, electric vehicle owners can also benefit from several other incentives, significantly reducing the overall cost of ownership. State and local governments, utility companies, and other stakeholders offer a variety of perks such as rebates, reduced registration fees, and special financing options. Furthermore, EV owners can take advantage of carpool lane access, free or discounted parking, and charging station incentives. To maximize your EV investment, it’s essential to research and capitalize on these additional incentives and benefits, which further minimize vehicle depreciation and contribute to a more sustainable and eco-friendly lifestyle.

GIPHY App Key not set. Please check settings