Are you ready to embrace the electric vehicle revolution and save money while doing so? Look no further, as we unveil the secrets of benefiting from the EV tax credit when leasing an electric vehicle. This comprehensive guide will help you navigate the ins and outs of this lucrative incentive, ensuring you reap the rewards of eco-friendly driving. So buckle up, and let’s drive towards a greener future by unlocking the full potential of the EV tax credit for your leased electric vehicle today!

Understanding the Federal EV Tax Credit and Its Impact on Your Electric Vehicle Lease

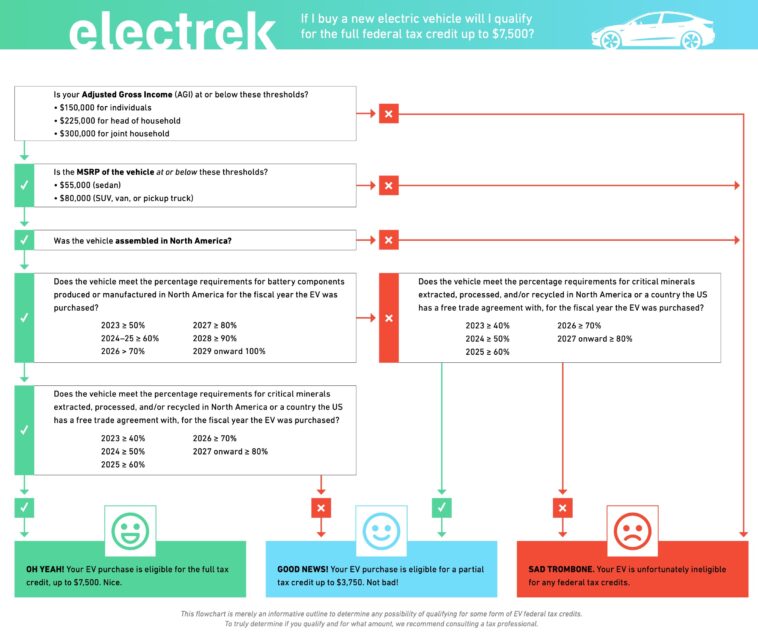

In order to maximize the benefits from the federal EV tax credit when leasing an electric vehicle, it’s crucial to have a clear understanding of how this incentive works. The federal tax credit ranges from $2,500 to $7,500, depending on the size of the vehicle’s battery capacity. This credit is designed to encourage the adoption of electric vehicles, making them more affordable for consumers. When leasing an EV, the tax credit is typically applied to the leasing company, which may pass on the savings to the customer in the form of lower monthly payments. As a potential EV lessee, having this knowledge can empower you to negotiate better leasing deals, ultimately reducing the overall cost of driving an environmentally-friendly vehicle.

Maximizing Your Savings: How to Combine EV Tax Credit with Additional State and Local Incentives

Maximizing your savings when leasing an electric vehicle (EV) is a smart move, and combining the federal EV tax credit with additional state and local incentives can lead to substantial financial benefits. To fully optimize your savings, research and apply for various state-level rebates, tax credits, and other incentives available in your area, as these can significantly reduce the overall cost of leasing an EV. Additionally, explore local utility company offers, such as discounts on home charging equipment or reduced electricity rates for EV owners. Combining the federal tax credit with these state and local incentives can help you enjoy the benefits of driving an eco-friendly vehicle while keeping more money in your pocket.

Leasing vs

When considering leasing an electric vehicle (EV), it’s essential to weigh the pros and cons against purchasing one outright. Leasing can be a financially savvy option, as it allows you to take advantage of the EV tax credit without the long-term commitment of ownership. With lower upfront costs and fixed monthly payments, leasing an EV provides an opportunity to drive a newer, more advanced model every few years, keeping you at the forefront of innovation and sustainability. Moreover, since most leases last for 2-3 years, you’ll likely avoid costly maintenance and battery replacement expenses. By understanding the benefits of leasing an EV and maximizing the available tax incentives, you can make an informed, eco-friendly decision that suits your lifestyle and budget.

Buying: Evaluating the Best Option for Your Electric Vehicle Needs and Tax Credit Benefits

When considering the purchase of an electric vehicle (EV), it’s essential to evaluate the best option to suit your needs while maximizing tax credit benefits. The federal EV tax credit can offer up to a $7,500 reduction on your taxes, making it a significant factor in your decision-making process. To ensure you’re making a well-informed choice, compare various EV models, review financing options, and research current incentives and rebates available in your state. Don’t forget to factor in long-term costs, such as maintenance and charging infrastructure. By taking time to analyze your options, you can reap the benefits of the EV tax credit and contribute to a cleaner, greener future.

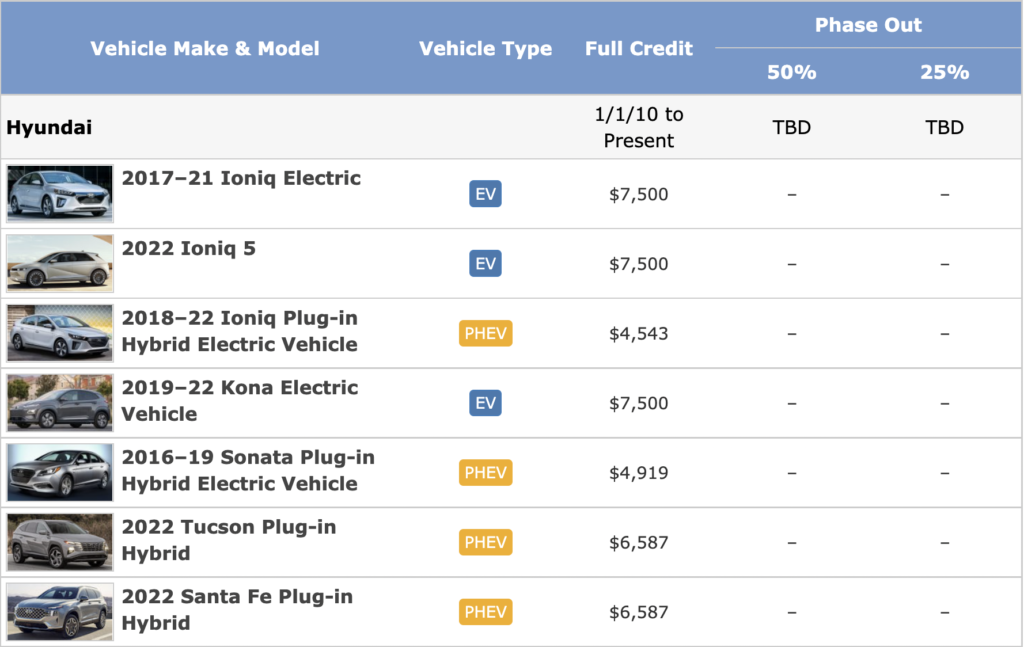

Choosing the Right Electric Vehicle Model: Top Cars Eligible for the EV Tax Credit in 2021

In 2021, selecting the right electric vehicle model is crucial to maximize your EV tax credit benefits. Top contenders eligible for the full $7,500 federal tax credit include the Chevrolet Bolt, Nissan Leaf, and Hyundai Kona Electric. These models boast impressive driving range, advanced technology features, and zero-emission powertrains, making them environmentally friendly and cost-effective options. Additionally, new entrants like the Ford Mustang Mach-E and Volkswagen ID.4 offer sleek designs and competitive performance, broadening your choices for a suitable EV. Remember to research the latest updates on tax credits and vehicle eligibility, as these may change over time, ensuring you make an informed decision and reap the benefits of driving a sustainable, tax credit-eligible electric vehicle.

Navigating the EV Lease Process: Essential Tips to Ensure a Smooth and Beneficial Transaction

In order to successfully navigate the EV lease process and maximize your savings, it’s crucial to follow essential tips for a smooth and beneficial transaction. Begin by conducting thorough research on available electric vehicles and their respective tax credits. Compare lease offers from multiple dealerships to ensure the best deal, and be prepared to negotiate. Keep in mind that the federal EV tax credit is typically factored into the lease price, so inquire about this to avoid any surprises. Finally, carefully review the lease agreement before signing, making note of any additional fees or conditions. By following these guidelines, you’ll be well-equipped to benefit from the EV tax credit when leasing an electric vehicle.

GIPHY App Key not set. Please check settings