Are you considering making the switch to an electric vehicle (EV) and looking to save some cash in the process? You’re in luck! The U.S. government offers an enticing financial incentive known as the EV tax credit, designed to encourage more people to embrace eco-friendly driving. In this comprehensive guide, we’ll walk you through everything you need to know about planning your electric vehicle purchase around this valuable tax credit, ensuring you maximize your savings and hit the road in style. So, buckle up and get ready to accelerate your journey towards a greener, wallet-friendly driving experience!

Understanding the EV Tax Credit: A Comprehensive Guide for Prospective Electric Vehicle Owners

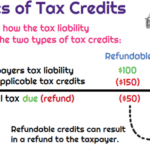

Dive into our comprehensive guide for prospective electric vehicle owners and learn everything you need to know about the EV tax credit. We’ll help you navigate the ins and outs of this government incentive, including eligibility requirements, credit amounts, and how to claim it on your tax return. With our expert advice and tips, you’ll be able to maximize your savings and make an informed decision when purchasing your eco-friendly ride. Don’t miss out on the financial benefits that come with going green – let our thorough understanding of the EV tax credit pave the way for your smooth transition to electric vehicle ownership!

Timing Your EV Purchase: How to Maximize the Savings with the Electric Vehicle Tax Credit

Timing your EV purchase is crucial to maximizing savings with the Electric Vehicle Tax Credit. To ensure you receive the full $7,500 tax credit, buy an eligible EV model before the manufacturer reaches 200,000 units sold in the US. Monitor sales and availability closely, as the credit phases out over time once that threshold is reached. Additionally, plan your purchase to coincide with the beginning of the tax year, allowing you to claim the credit sooner. Don’t forget to check for additional state and local incentives, which can further reduce the overall cost of your electric vehicle. By carefully strategizing your purchase, you can make the most of financial incentives and save significantly on your eco-friendly investment.

Top Electric Vehicles Eligible for the EV Tax Credit: Making an Informed Decision for Your Next Purchase

When planning your electric vehicle (EV) purchase, it’s crucial to consider the top EV models that qualify for the federal EV tax credit. These eco-friendly cars not only reduce your carbon footprint but also offer significant cost savings. Some popular EV models eligible for the tax credit include the Chevrolet Bolt, Nissan LEAF, Tesla Model 3, and the Hyundai Kona Electric. To make an informed decision, research each vehicle’s range, charging options, performance, and available features. Compare these factors with your driving needs and budget to determine which EV best suits your lifestyle. Remember, the tax credit can save you thousands on your next purchase, so it’s essential to stay up-to-date with eligible models and plan accordingly.

Navigating the EV Tax Credit Expiration: Key Strategies for Planning Your Electric Vehicle Investment

Navigating the EV Tax Credit Expiration requires strategic planning to maximize your electric vehicle investment. To ensure you’re well-informed, research the latest updates on the tax credit program, including the phase-out schedule for each manufacturer. Prioritize purchasing from automakers who still offer the full credit, and keep an eye on upcoming EV models that meet your requirements. Consider pre-booking or placing a deposit to secure your spot in the queue, as the credits are awarded on a first-come, first-served basis. By staying up-to-date with the EV market and making timely decisions, you can enjoy substantial savings from the tax credits available.

EV Financing and Tax Credit Tips: Expert Advice for Streamlining Your Electric Vehicle Purchase Process

When planning to purchase an electric vehicle (EV), it’s essential to consider the available financing options and tax credits to get the best deal. To streamline your EV purchase process, seek expert advice from industry professionals and financial institutions. They can provide valuable insights on various financing options, including loans, leases, and cash purchases. Moreover, they can guide you on how to take advantage of the federal EV tax credit, state incentives, and local rebates that can significantly reduce the cost of your electric vehicle. By understanding these incentives and aligning them with your financial goals, you’ll be better equipped for a hassle-free EV buying experience.

GIPHY App Key not set. Please check settings