Are you ready to go green and save some serious cash? With the growing popularity of electric vehicles, it’s no surprise that the government is offering an attractive incentive to make the switch even more appealing. Enter the Electric Vehicle (EV) Tax Credit, a game-changing financial boost for eco-conscious drivers. In this comprehensive step-by-step guide, we’ll walk you through the entire process on how to claim the EV tax credit on your tax return, ensuring you reap the full benefits of your environmentally friendly investment. So buckle up, and let’s accelerate your journey towards sustainable driving and significant savings!

Understanding the Eligibility Criteria for the Electric Vehicle Tax Credit: A Comprehensive Overview

Understanding the eligibility criteria for the Electric Vehicle (EV) Tax Credit is crucial for maximizing your potential savings. This comprehensive overview will help you determine if your EV purchase qualifies for the tax credit. The primary factors affecting eligibility include the vehicle’s make and model, battery capacity, and whether it is new or used. Additionally, your tax liability, income levels, and the timing of your purchase play a role in determining the credit amount you can claim. By familiarizing yourself with these criteria, you can make informed decisions and potentially save thousands of dollars on your eco-friendly vehicle purchase.

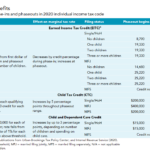

Decoding the EV Tax Credit: Calculating Your Potential Savings on Your Tax Return

In this blog post, we’ll help you navigate the process of claiming the EV Tax Credit on your tax return by providing a step-by-step guide. This valuable tax incentive can significantly reduce the cost of purchasing an electric vehicle (EV). To maximize your potential savings, it’s essential to understand how the credit is calculated based on the battery capacity and the manufacturer’s sales. We’ll break down the necessary information, ensuring you’re fully equipped to take advantage of this eco-friendly tax benefit. By following our guidelines, you’ll be on your way to driving a more sustainable vehicle while enjoying some significant tax savings.

The Essential Documentation for Claiming Your Electric Vehicle Tax Credit: What You Need to Know

When claiming the Electric Vehicle (EV) Tax Credit on your tax return, it’s vital to gather the essential documentation to ensure a smooth process. This includes obtaining the Manufacturer’s Certification Statement, which provides proof of your EV’s eligibility for the credit. Make sure to retain a copy of the purchase or lease agreement, as well as the vehicle’s registration. Additionally, keep a record of the Vehicle Identification Number (VIN) and the date of acquisition. With these crucial documents in hand, you’ll be well-prepared to claim your EV Tax Credit accurately and efficiently, maximizing your potential savings and benefits.

Navigating the IRS Form 8936: A Detailed Guide to Claiming Your EV Tax Credit Successfully

In this comprehensive guide, we’ll help you navigate the IRS Form 8936, ensuring you claim your EV tax credit successfully and with ease. As an electric vehicle owner, you’re eligible for a federal tax credit of up to $7,500, making it essential to know how to complete this form accurately. We’ll cover essential details on Form 8936, such as the purpose, required information, and the step-by-step process of filling it out correctly. By following our expert advice, you’ll maximize your tax savings and contribute to a greener future. Don’t miss out on this valuable opportunity – read on to become an IRS Form 8936 pro!

Common Mistakes to Avoid When Claiming the Electric Vehicle Tax Credit: Expert Tips and Advice

When claiming the Electric Vehicle (EV) tax credit on your tax return, it’s crucial to avoid common mistakes that may impact your eligibility and the credit amount. Ensure that you’ve purchased a qualifying EV, as not all models are eligible for the tax credit. Accurately report the vehicle’s purchase date, as the credit is only available for new vehicles acquired for personal use. Don’t forget to complete IRS Form 8936 and attach it to your tax return, providing all necessary information. Finally, be aware of the credit phase-out rule for each manufacturer, as this may affect the credit amount you’re eligible for. By following these expert tips and advice, you can maximize your EV tax credit claim and avoid potential pitfalls.

GIPHY App Key not set. Please check settings