Are you ready to take the leap into the world of electric vehicles (EVs), but worried about missing out on the valuable tax credits? Fear not, as our comprehensive guide will help you successfully navigate the EV tax credit phase-out for eligible manufacturers, ensuring you maximize your savings. Dive into the ever-evolving world of electric cars and discover how to secure these lucrative incentives before they disappear, making your eco-friendly driving dream a reality. Stay ahead of the curve and let’s electrify your journey together!

Understanding the EV Tax Credit Phase-Out Timeline for Top Manufacturers: Stay Informed and Maximize Savings

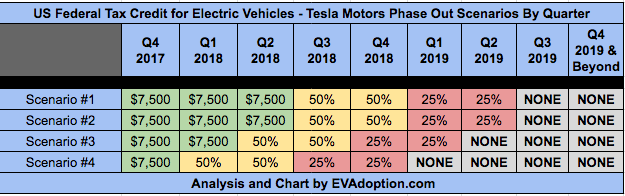

Understanding the EV Tax Credit Phase-Out Timeline for top manufacturers is crucial to staying informed and maximizing your savings on electric vehicles. As demand for electric cars continues to surge, it is essential to be aware of the current tax incentives and their expiration dates for leading manufacturers like Tesla, Chevrolet, and Nissan. By keeping track of these phase-out timelines, you can strategically time your purchase and effectively reduce the overall cost of your next eco-friendly vehicle. Explore the latest information on EV tax credits, stay updated on the changing policies, and make the most of these government incentives to save money and contribute to a greener future.

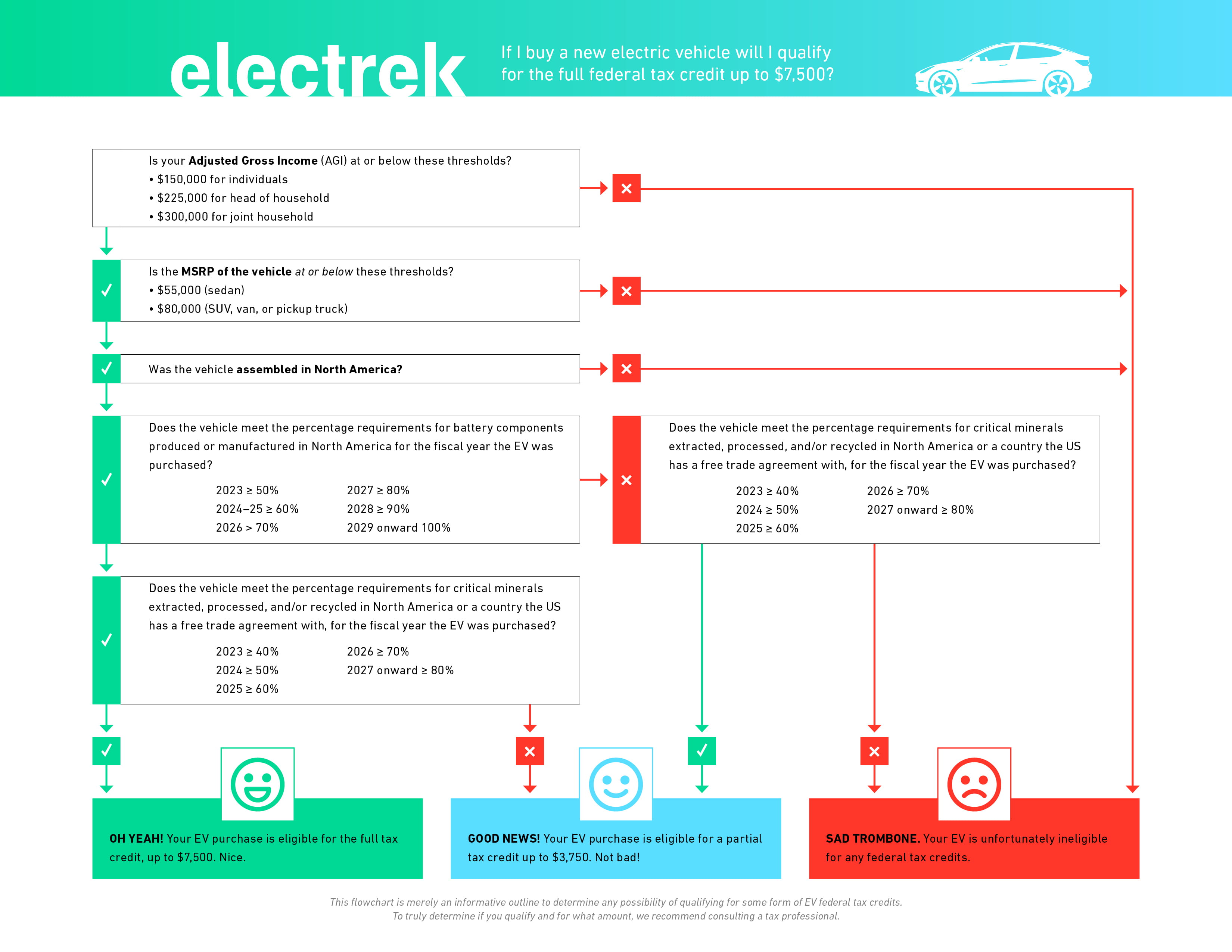

Decoding the Phase-Out Process: Important Factors to Consider for Your Electric Vehicle Purchase Decision

When planning to purchase an electric vehicle (EV), it’s crucial to understand the phase-out process of the EV tax credit for eligible manufacturers. This will help you make an informed decision and maximize the potential financial benefits. To do so, research the manufacturer’s progress towards the 200,000-vehicle threshold, as this determines when the tax credit begins to phase out. Stay updated on the current quarter and the following two quarters, as these are crucial periods for the credit’s reduction. Additionally, explore alternative state and local incentives that may still be available for your EV purchase. By thoroughly examining these factors, you can take full advantage of the financial incentives offered while contributing to a greener environment.

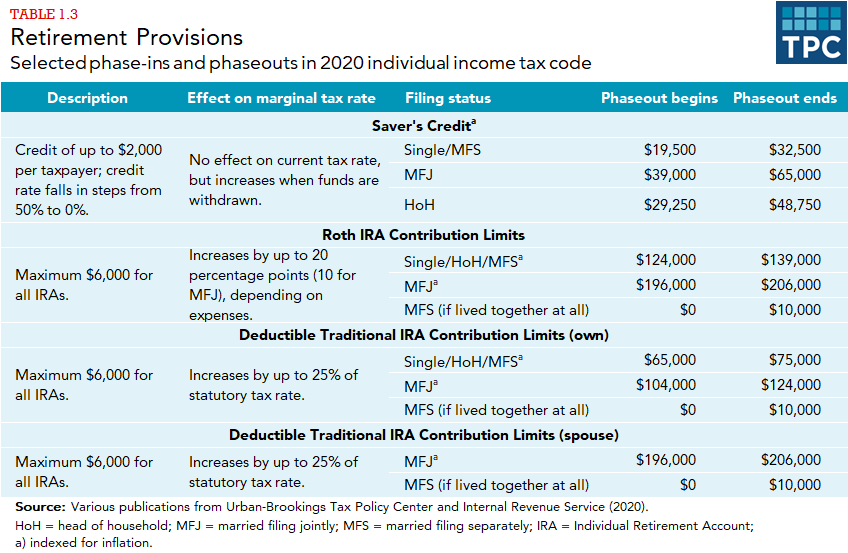

Exploring Alternatives: State Incentives and Rebates to Supplement EV Tax Credit Reductions

In addition to federal EV tax credits, many states offer their own incentives and rebates to further promote the adoption of electric vehicles. As the federal EV tax credit phase-out continues for eligible manufacturers, it’s essential to explore state-level alternatives to maximize savings on your electric vehicle purchase. State incentives and rebates can vary significantly, including benefits such as reduced vehicle taxes, registration fee waivers, and even discounted charging station installation costs. To optimize your EV investment, research your state’s specific programs and requirements to determine which incentives best align with your needs and preferences. Stay updated on regional developments as state policies often change to adapt to the growing EV market.

The Future of Electric Vehicle Incentives: What to Expect as More Manufacturers Reach Phase-Out Thresholds

As electric vehicle (EV) adoption continues to accelerate, it’s crucial to stay informed on the future of EV incentives, particularly as more manufacturers approach the phase-out thresholds. With leading automakers like Tesla and General Motors already surpassing these limits, we can anticipate further changes to the tax credit system. Governments may introduce new policies and incentives to boost EV sales and promote sustainable transportation, such as expanding charging infrastructure or offering local incentives. By keeping an eye on these developments, consumers can make informed decisions and take advantage of the best incentives available to support their transition to electric mobility.

Navigating the EV Market: Strategies to Secure the Best Deals as Tax Credits Diminish for Popular Brands

Navigating the EV market can be challenging, especially with diminishing tax credits for popular brands. To secure the best deals, it’s crucial to stay informed about the latest industry trends, incentives, and manufacturer phase-out schedules. Start by researching top EV models, comparing their features, and focusing on those nearing the end of their tax credit eligibility. Sign up for newsletters from automakers and dealerships to receive notifications about special offers and promotions. Consider pre-owned electric vehicles or models with lower demand to take advantage of potential discounts. Lastly, be prepared to act quickly and negotiate with dealers to secure the most competitive pricing as tax credits continue to decrease.

GIPHY App Key not set. Please check settings