Are you considering joining the electric vehicle (EV) revolution and want to make the most of the financial incentives available? You’ve come to the right place! In this comprehensive guide, we’ll help you navigate the ins and outs of the EV tax credit, ensuring you’re well-equipped to determine if your chosen electric car qualifies for this lucrative benefit. By understanding the eligibility criteria, you’ll be able to maximize your savings and contribute to a sustainable future with your eco-friendly ride. So, buckle up and let’s explore the exciting world of electric vehicle tax credits!

Understanding the EV Tax Credit: Eligibility Criteria for Electric Vehicles

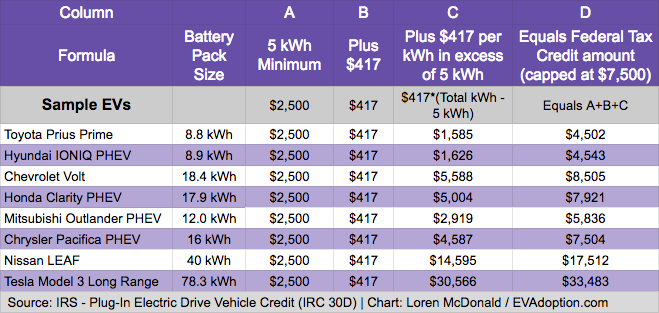

In order to fully understand if your electric vehicle qualifies for the EV Tax Credit, it’s essential to become familiar with the eligibility criteria set by the government. Key factors that determine your EV’s eligibility include the vehicle’s make, model, battery capacity, and the date of purchase. Generally, EVs with a battery capacity of at least 4 kilowatt-hours (kWh) are eligible for the credit, with the amount increasing based on battery size. Additionally, the vehicle must be purchased new and primarily for use in the United States. Keep in mind that the EV Tax Credit begins to phase out once a manufacturer has sold 200,000 qualifying vehicles, so it’s crucial to stay updated on the current status of your preferred automaker.

The Importance of Battery Size and Range: Key Factors in EV Tax Credit Qualification

The battery size and range of your electric vehicle play a crucial role in determining its eligibility for the EV tax credit. The capacity of the battery, measured in kilowatt-hours (kWh), directly influences the driving range of your EV. To qualify for the full tax credit, your vehicle must have a battery capacity of at least 4 kWh and a minimum electric range of 16 miles. As the battery size and range increase, so does the potential tax credit amount, up to the maximum of $7,500. Ensuring your EV meets these key criteria not only helps you enjoy the environmental benefits of driving an electric vehicle but also maximizes the financial incentives available to you.

New vs

In your quest for an electric vehicle (EV), it’s essential to understand the difference between new and used EVs when considering the EV tax credit. To qualify for the federal tax credit, you must purchase a new, eligible electric vehicle. Unfortunately, used EVs do not qualify for this incentive. Additionally, the vehicle must be primarily for personal, family, or business use, and you must drive it within the United States. By researching each vehicle’s eligibility and understanding the distinction between new and used EVs, you can make an informed decision while taking advantage of the financial benefits offered by the EV tax credit.

Used Electric Vehicles: How Purchase Year Affects Your EV Tax Credit Eligibility

When considering purchasing a used electric vehicle, it’s essential to understand how the purchase year affects your eligibility for the EV tax credit. The IRS only offers this credit for new EVs, meaning that used electric vehicles are generally ineligible for the tax benefit. However, if the original owner did not claim the credit, you may qualify. To maximize your chances of receiving the EV tax credit, research the vehicle’s history and confirm that it has not been previously claimed. Keep in mind that each electric vehicle model has a specified cap of 200,000 units for the tax credit, so verify that the model you’re interested in hasn’t reached this limit.

Manufacturer Limits and Phase-Outs: How Brand Choices Impact Your EV Tax Credit Claim

When considering an electric vehicle (EV) purchase, it’s essential to understand how manufacturer limits and phase-outs can impact your eligibility for the EV tax credit. The tax credit begins to phase out once a manufacturer sells 200,000 qualifying vehicles in the United States. As a result, popular brands like Tesla and Chevrolet have already reached this limit, meaning their EVs are no longer eligible for the full credit. To maximize your tax credit claim, research the sales figures of various automakers and choose a brand that has not yet hit the phase-out threshold. By staying informed about the latest developments in the EV market, you can make a savvy purchase and take full advantage of available tax incentives.

Navigating the EV Tax Credit Application Process: Essential Steps for Maximizing Your Savings

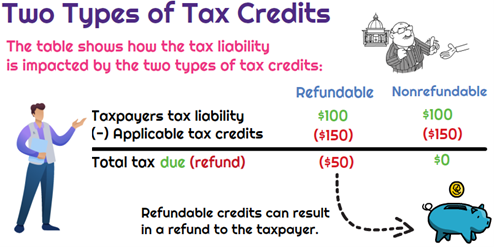

Navigating the EV Tax Credit Application Process can be a daunting task, but with the right approach, you can maximize your savings effortlessly. Start by researching the specific eligibility criteria for your desired electric vehicle – this includes factors like battery capacity, vehicle type, and the manufacturer’s sales cap. Next, ensure you’re the original owner of the vehicle and have a tax liability that’s equal to or greater than the credit amount. Once you’ve confirmed eligibility, gather essential documents like the vehicle purchase agreement, IRS Form 8936, and proof of vehicle registration. By understanding the requirements and staying organized, you’ll be well-prepared to claim your EV tax credit and enjoy significant savings.

GIPHY App Key not set. Please check settings