Are you considering making the switch to an electric vehicle (EV) and want to save money on your purchase? Look no further, as we’re here to guide you on how to leverage the EV tax credit, a valuable incentive designed to promote the adoption of eco-friendly transportation. By taking full advantage of this tax credit, you can significantly reduce your total vehicle cost, making your transition to a greener lifestyle more affordable than ever. Read on as we demystify the process and provide practical tips for making the most of this incredible opportunity to save big on your dream electric car.

Understanding the Federal EV Tax Credit: A Comprehensive Guide to Maximize Your Savings

Delve into the world of electric vehicles and learn how to maximize your savings with our comprehensive guide on the Federal EV Tax Credit. This guide will walk you through the ins and outs of the credit, enabling you to make the most out of your EV purchase. By understanding the eligibility criteria, credit phase-out schedules, and state-level incentives, you can significantly reduce your total vehicle cost. Stay ahead of the curve and make an eco-friendly choice while saving money. Don’t miss out on this incredible opportunity to go green and save green at the same time!

Top Tips to Strategically Time Your Electric Vehicle Purchase for Optimal Tax Credit Benefits

Maximize your savings on an electric vehicle (EV) by strategically timing your purchase to take full advantage of the federal tax credit. Research the specific EV model you’re interested in, as the credit amount varies depending on the vehicle’s battery capacity. Keep in mind that the tax credit begins to phase out once a manufacturer sells 200,000 qualifying vehicles in the United States. So, track the manufacturer’s sales numbers and act swiftly when approaching this threshold. Also, consider buying your EV towards the end of the year, as you’ll be able to claim the tax credit sooner, reducing your overall vehicle cost more rapidly. Stay updated with the latest EV tax credit policies and incentives to make an informed decision.

Debunking Common Myths About the Electric Vehicle Tax Credit: Get the Facts Straight and Save More

In this section, we’ll debunk common myths about the Electric Vehicle (EV) Tax Credit and provide accurate information to help you save more on your EV purchase. Misconceptions surrounding the EV tax credit can deter potential buyers, but understanding the facts can significantly reduce your total vehicle cost. We’ll discuss eligibility requirements, tax credit amounts, and how to claim the credit on your tax return. By gaining a clear understanding of the EV tax credit, you’ll be better equipped to make an informed decision and maximize your savings when purchasing an electric vehicle. Learn the truth about the EV tax credit and start saving today!

How to Combine State and Local Incentives with the Federal EV Tax Credit for Maximum Vehicle Cost Reduction

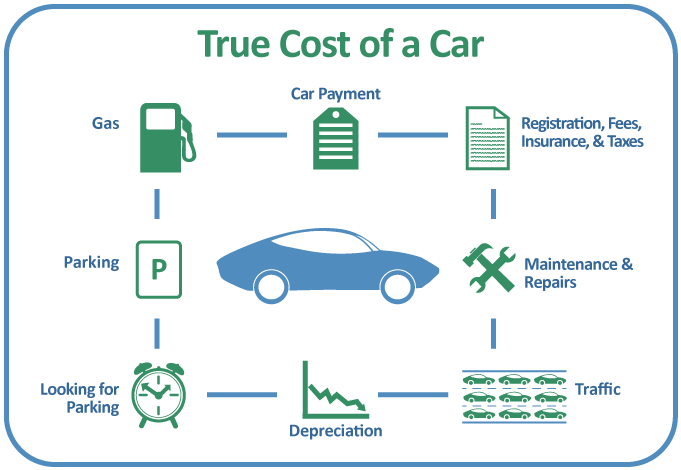

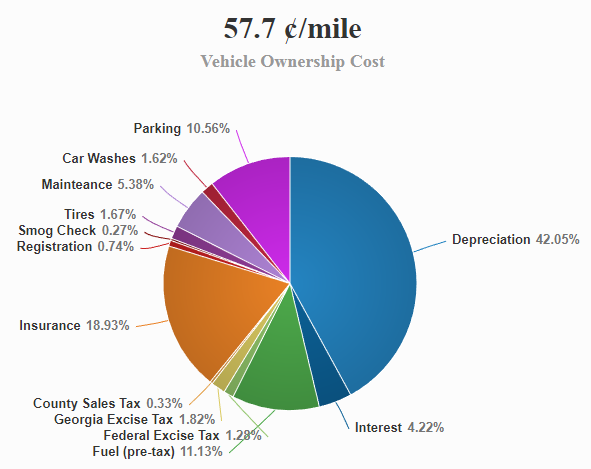

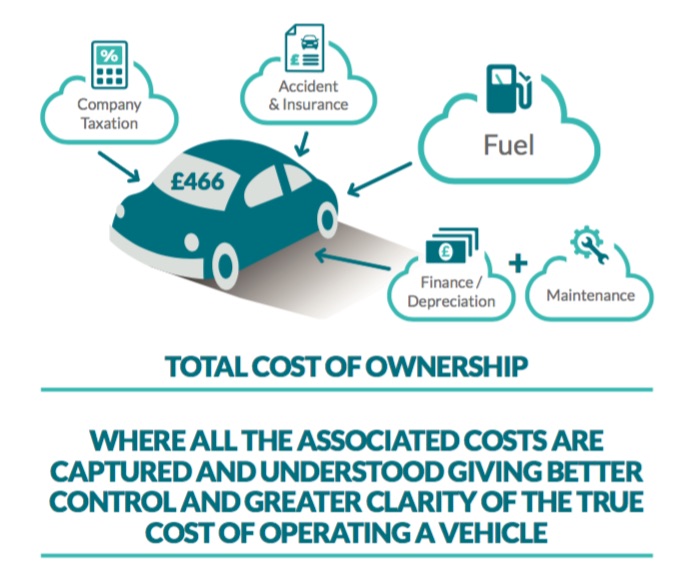

To maximize your vehicle cost reduction, it’s essential to combine state and local incentives with the Federal EV Tax Credit effectively. Begin by researching available state and local rebates, grants, tax credits, and other financial incentives in your area. These incentives can significantly lower your overall vehicle cost when combined with the federal tax credit. Be sure to consider factors such as your state’s specific eligibility requirements and the expiration dates for each incentive. By strategically leveraging these incentives, you can make the switch to an electric vehicle more affordable and eco-friendly, ultimately reducing your carbon footprint and saving money on fuel and maintenance costs.

Electric Vehicle Financing Options: How to Take Advantage of the EV Tax Credit in Your Loan or Lease Agreement

When considering electric vehicle financing options, it is crucial to understand how to fully leverage the EV tax credit in your loan or lease agreement, ultimately reducing your total vehicle cost. By incorporating the federal tax credit into your financing terms, you can potentially lower your monthly payments or negotiate a more favorable interest rate. To maximize these benefits, research and compare various financing institutions to find the best loan or lease terms available. Additionally, consult with a tax professional to ensure you meet all eligibility requirements for the tax credit, and stay informed of any state-specific incentives or rebates that may further enhance your overall savings on your electric vehicle.

GIPHY App Key not set. Please check settings