Stay ahead of the curve and keep your electric vehicle (EV) investment savvy by closely monitoring proposed EV tax credit legislation and updates. With the rapidly evolving landscape of electric mobility, it’s more important than ever to stay informed about the latest policy changes affecting your eco-friendly ride. Our comprehensive guide will provide you with the essential tools and strategies to track EV tax incentives, ensuring you capitalize on every dollar-saving opportunity. So, buckle up and get ready to navigate the dynamic world of EV tax credits with confidence and ease.

Understanding the Basics of EV Tax Credit Legislation: A Comprehensive Guide

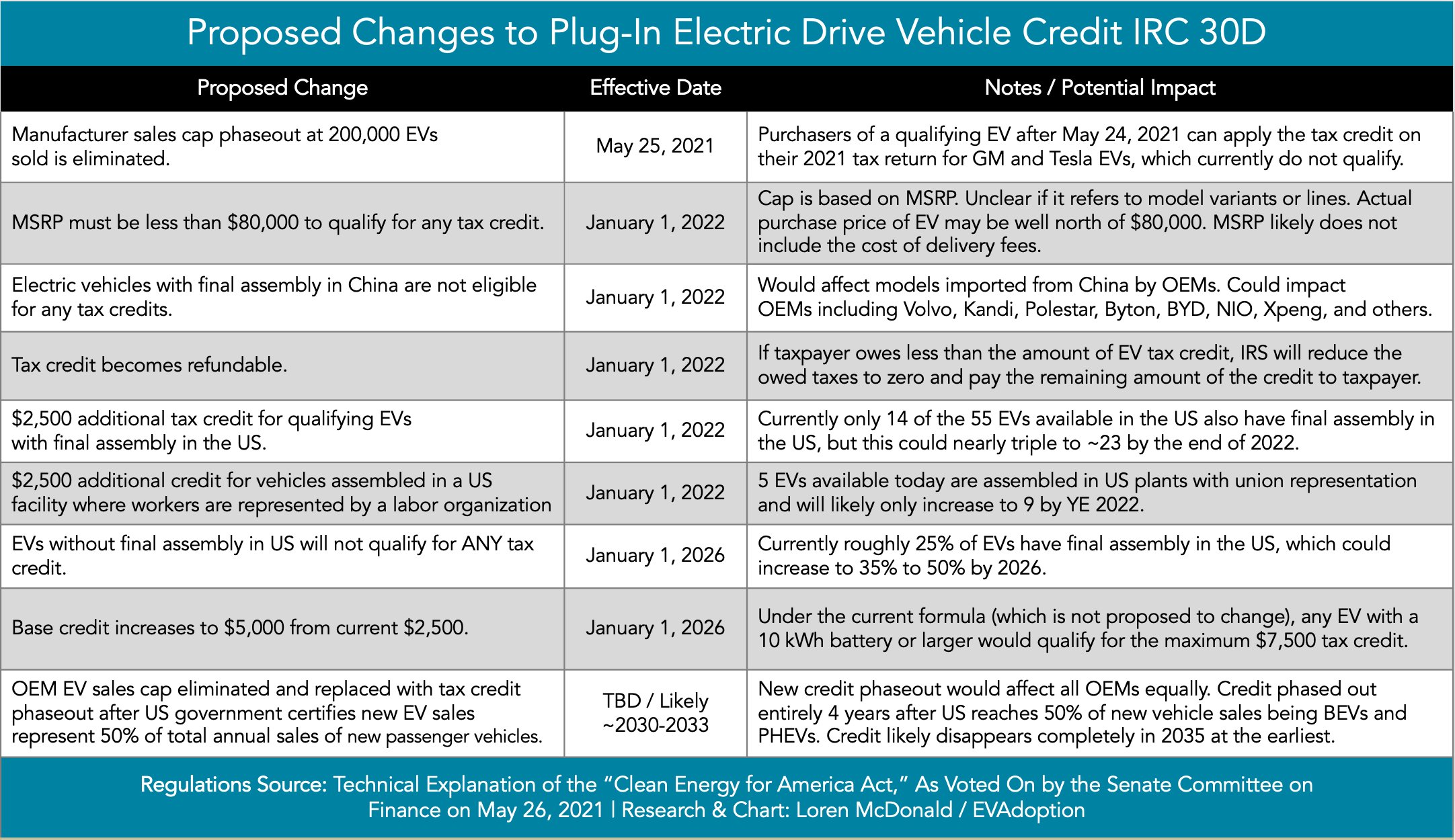

Dive into the world of EV tax credit legislation with our comprehensive guide that breaks down the essentials for you. Stay informed about the latest updates, proposed changes, and new policies concerning electric vehicle tax credits. Grasp the fundamental principles behind these incentives and learn how they impact both consumers and the EV market. As governments worldwide aim to reduce carbon emissions and promote sustainable transportation, understanding the basics of EV tax credit legislation is crucial. Our in-depth guide will equip you with the knowledge to make informed decisions and keep a close eye on the ever-evolving landscape of electric vehicle tax incentives.

Staying Informed: Top Resources for Tracking Proposed EV Tax Credit Changes and Updates

Stay up-to-date with the latest developments in EV tax credit legislation by utilizing top resources for tracking proposed changes and updates. Bookmark reputable news outlets and websites dedicated to electric vehicles, such as InsideEVs, Electrek, and Green Car Reports. These platforms provide timely information on policy changes, industry news, and expert insights. Additionally, follow key stakeholders on social media, such as the Electric Drive Transportation Association (EDTA) and the National Conference of State Legislatures (NCSL), to receive real-time updates on electric vehicle incentives. By leveraging these resources, you can ensure you’re well-informed on the ever-evolving landscape of EV tax credits and related legislation.

The Future of Electric Vehicles: How Proposed Tax Credits Could Shape the EV Market

The future of electric vehicles (EVs) is undoubtedly promising, with proposed tax credits playing a pivotal role in shaping the EV market. By closely monitoring these legislative updates, consumers and industry stakeholders can stay informed about potential cost-saving incentives, thereby driving EV adoption and fostering sustainable transportation. As automakers continue to invest in innovative EV technology, these tax credits are expected to bolster market growth, making electric vehicles more accessible to a wider audience. With a growing shift towards green energy, understanding the impact of proposed EV tax credits is indispensable in anticipating market trends and making informed decisions.

Navigating the EV Tax Credit Landscape: Essential Tips for Monitoring Legislation and Updates

Navigating the electric vehicle (EV) tax credit landscape can be challenging, but staying informed about proposed legislation and updates is crucial. To monitor these changes effectively, begin by subscribing to industry-specific newsletters and following key organizations, such as the Electric Drive Transportation Association (EDTA) and the Department of Energy (DOE). Engaging with online communities, such as EV forums and social media groups, can provide valuable insights and firsthand experiences. Additionally, tracking the progress of bills through government websites, like Congress.gov, will ensure you stay up-to-date with the latest EV tax credit proposals and amendments. By utilizing these resources, you’ll be well-equipped to adapt to the ever-evolving world of EV incentives.

From Proposal to Law: The Journey of EV Tax Credit Legislation and its Impact on Consumers

Navigating the complex world of EV tax credit legislation can be challenging for consumers. Staying informed on the progression of these proposals is crucial, as they hold the potential to significantly impact electric vehicle affordability and adoption. From the initial proposal stages to becoming law, tracking EV tax credit legislation updates allows consumers to make informed decisions about purchasing an electric vehicle. By understanding the legislative process and the implications of these tax incentives on the electric vehicle market, consumers can take advantage of these benefits and contribute to a more sustainable future. Keep a close eye on emerging policies, and don’t miss out on potential savings when making the switch to an electric vehicle.

GIPHY App Key not set. Please check settings