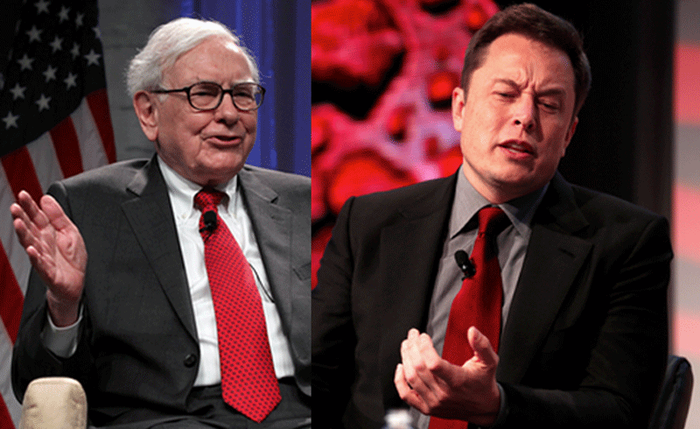

Elon Musk and Warren Buffett seem to have the same investment principles when it comes to the stock market.

Billionaire and inventor, Elon Musk shared some investing advice for crypto investors on Twitter.

When it comes to buying investments, stock in companies that make products you believe in is the best bet. When the market fluctuates, don’t panic; calmly sell when you think the trend is going nowhere but up.

The tweet is a summarization of the basic principles of investing. Based on value, it also reflects Warren Buffet’s recommendations.

When deciding on this type of investment, it is vital that you only select companies whose business model you understand and believe in.

Value investors are focused on long-term gains and don’t follow trends or short-term movements in the market.

Musk offered to buy Twitter for $44 billion. He said that he wants to unlock their potential, as the company board agreed.

Musk’s message to not panic when the market is down reiterated one of Buffett’s famous quotes. He says to be fearful when the market is up and greedy when the market is down.

If inflation is high, it’s better to own physical assets like a home or stock of a company that makes good products.

“I won’t sell my Bitcoin, Ethereum, or Doge since I still own it.”

Elon Musk

Warren Buffett still opposes bitcoin as investing, as it has yet to be tangible. Even though this is generally accepted, he still stands by his original judgment and sees it as rat poison squared.

Elon Musk has encouraged people to develop products and provide services to humans rather than investing in cryptocurrency. Musk has warned against betting too heavily on cryptocurrencies.

GIPHY App Key not set. Please check settings