Are you considering joining the electric vehicle revolution and reaping the benefits of eco-friendly driving? Look no further! Our comprehensive guide on how to choose an electric vehicle that qualifies for the EV tax credit will help you navigate the world of green transportation with ease. Don’t miss out on substantial savings and fantastic performance – read on to discover the top factors to consider, the most popular electric vehicles eligible for tax credits, and how to claim this attractive incentive. Together, let’s charge ahead towards a cleaner, greener future!

Understanding the Eligibility Criteria for the EV Tax Credit: Get the Best Deal on Your Electric Vehicle Purchase

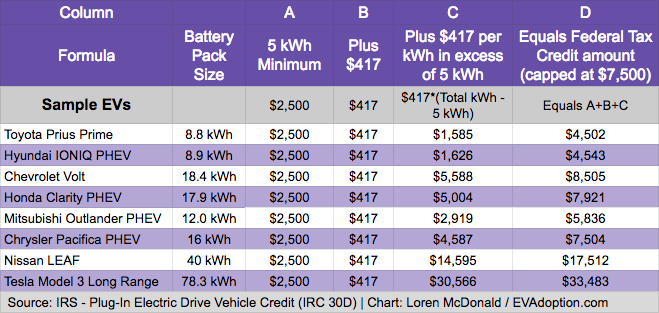

To ensure you get the best deal on your electric vehicle (EV) purchase, it’s crucial to understand the eligibility criteria for the EV tax credit. This federal incentive offers a tax credit of up to $7,500 for qualifying electric vehicles, which can significantly reduce your overall vehicle cost. To be eligible, the EV must be a new, plug-in model with a battery capacity of at least 4 kWh. Additionally, the credit starts to phase out once a manufacturer sells 200,000 qualifying vehicles in the United States. By staying informed about these criteria, you’ll be better equipped to select an EV that maximizes your savings and aligns with your eco-friendly goals.

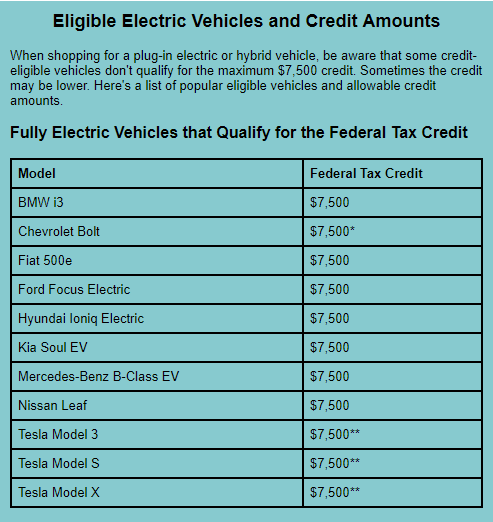

Top Electric Vehicle Models that Qualify for the Maximum Tax Credit: Make an Informed Choice for Your Green Ride

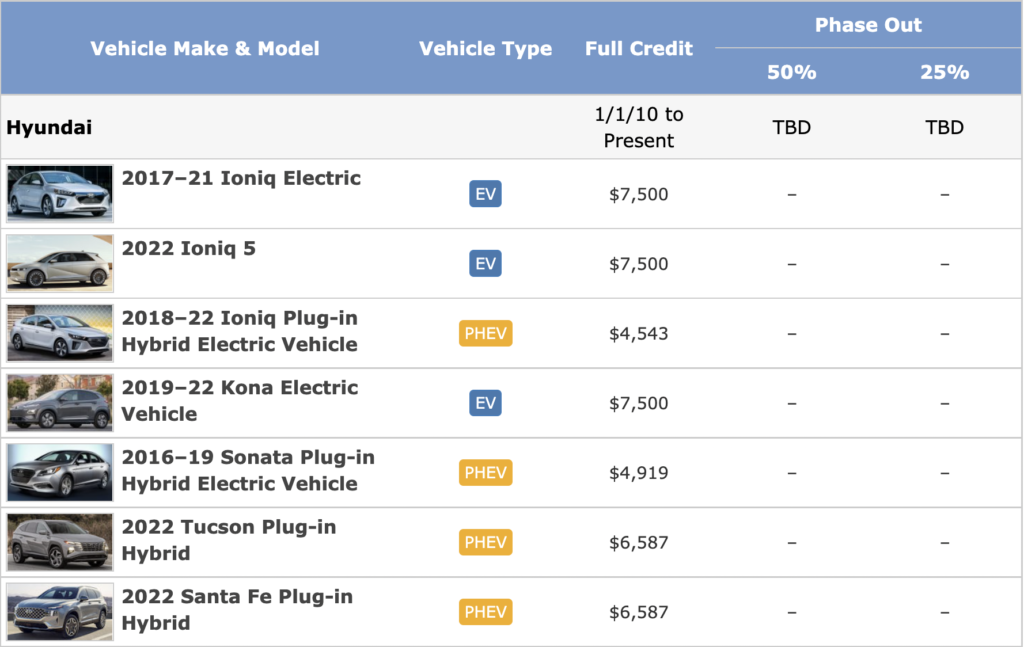

When selecting the ideal electric vehicle (EV) that qualifies for the maximum tax credit, it’s essential to make an informed decision based on your needs and preferences. Research the top EV models, such as the Tesla Model 3, Chevrolet Bolt, and Nissan Leaf, which offer impressive features, performance, and range. Compare their specifications, price, and overall value to ensure you’re investing in a reliable and efficient green ride. Additionally, consider the availability of charging stations and maintenance support in your area to optimize your electric vehicle experience. By making a well-informed choice, you can enjoy the benefits of an eco-friendly vehicle while also taking advantage of the EV tax credit.

EV Tax Credit Expiration and Phase-Out: Stay Updated on the Latest Changes to Maximize Your Benefits

Staying informed on the latest updates regarding the EV Tax Credit expiration and phase-out is essential for maximizing your benefits when purchasing an electric vehicle. As manufacturers reach the 200,000-unit threshold for eligible vehicles, tax credits begin to phase out, reducing the potential savings for buyers. Consequently, keeping a close eye on the current status of each manufacturer’s tax credit eligibility can help you make well-informed decisions on your next EV purchase. Don’t miss out on valuable incentives—regularly check for updates from the IRS, news articles, and reputable online resources to ensure you’re making the most of the available EV tax credits.

Tips to Ensure a Smooth EV Tax Credit Application Process: Avoid Common Mistakes and Save Time

When applying for the EV tax credit, it’s crucial to avoid common mistakes to ensure a smooth application process and save time. To achieve this, begin by accurately completing Form 8936 and providing necessary documentation to prove your eligibility. Double-check the vehicle’s make, model, and battery capacity to confirm it meets the requirements. It’s essential to understand that leasing an EV does not qualify you for the tax credit, as the leasing company receives the benefit. Additionally, be aware that the credit starts to phase out once a manufacturer has sold 200,000 qualifying vehicles. Keeping these tips in mind will help you maximize your savings and streamline the EV tax credit application process.

Combining State and Federal Incentives for Electric Vehicles: Boost Your Savings on an Eco-Friendly Purchase

When purchasing an electric vehicle (EV), it’s essential to maximize your savings by combining state and federal incentives. These eco-friendly purchases qualify for the EV tax credit, which can significantly reduce your costs. To boost your savings, research your state’s specific EV incentives, such as rebates, tax credits, and reduced registration fees. Additionally, explore local utility programs that offer discounts on charging equipment or lower electricity rates for EV owners. By taking advantage of these combined incentives, you’ll not only save money on your electric vehicle purchase but also contribute to a greener and more sustainable future.

GIPHY App Key not set. Please check settings