Stay ahead of the curve and maximize your electric vehicle (EV) investment with our comprehensive guide on keeping up-to-date with the latest EV tax credit changes. As the world shifts towards sustainable transportation, governments are constantly updating incentives to encourage EV adoption. Don’t miss out on these valuable benefits! In this article, we’ll help you navigate the ever-evolving landscape of EV tax credits, ensuring you’re always informed and ready to reap the rewards of your eco-friendly vehicle choice. Keep reading to unlock the secrets to staying current on EV tax credit changes and boosting your overall driving experience.

Navigating the Complex World of Electric Vehicle Tax Credits: A Comprehensive Guide

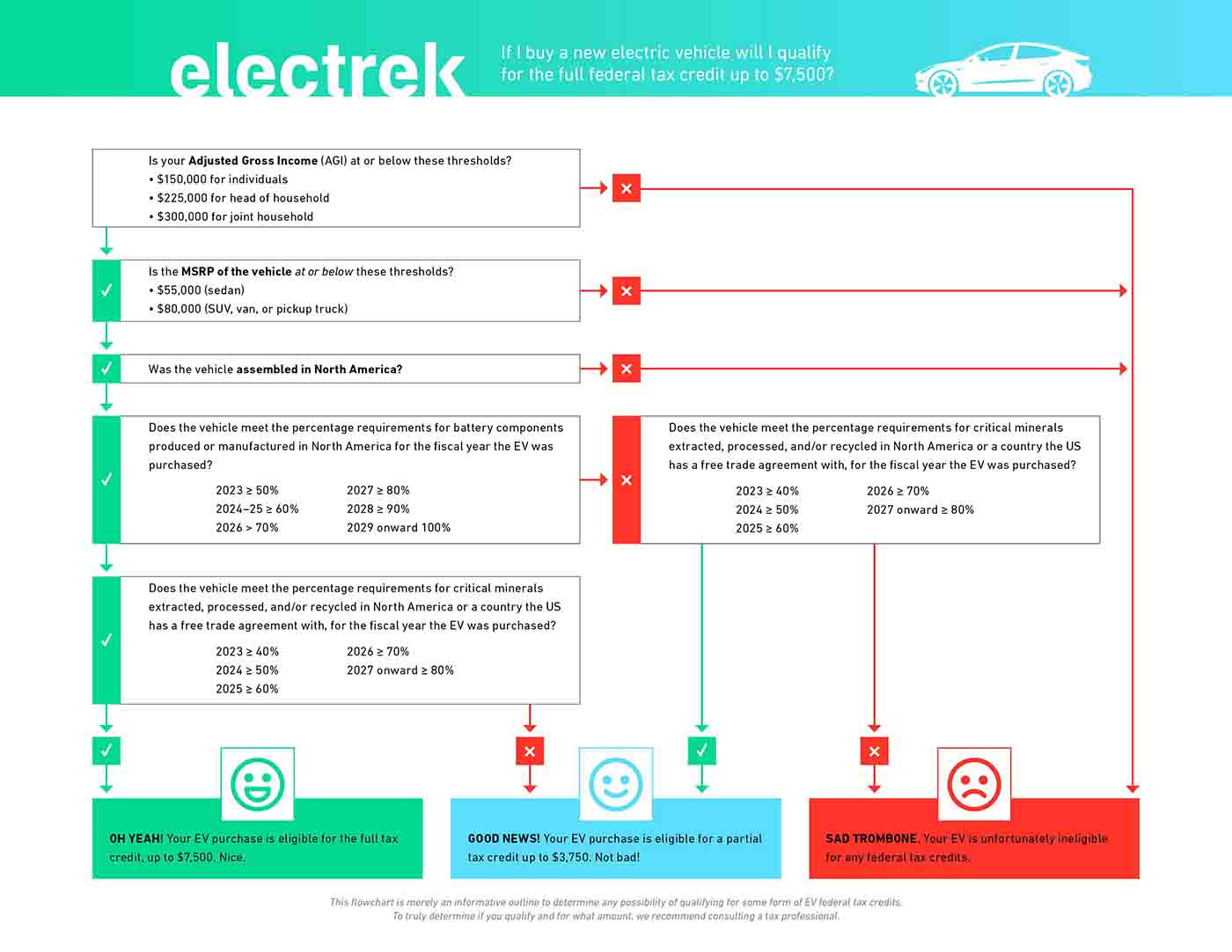

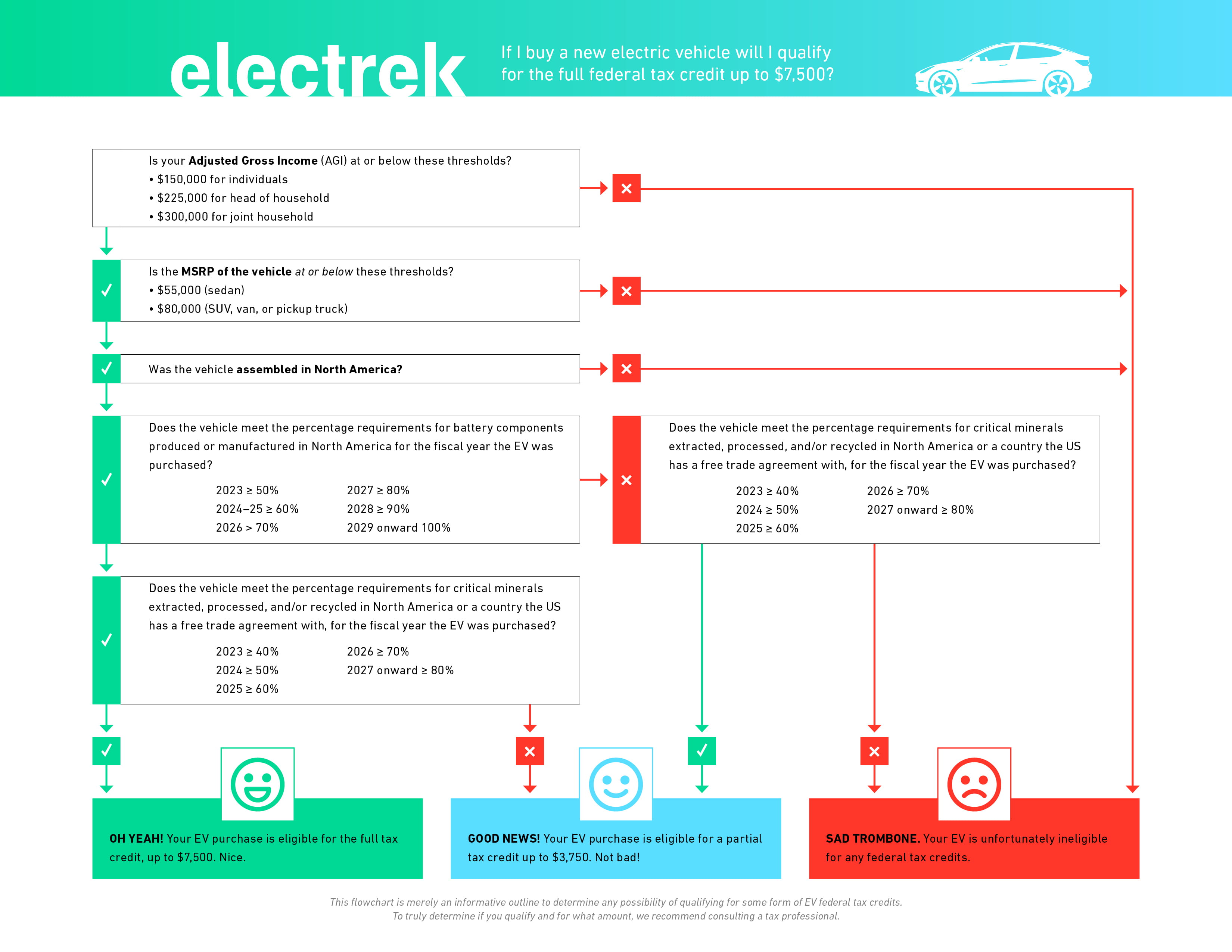

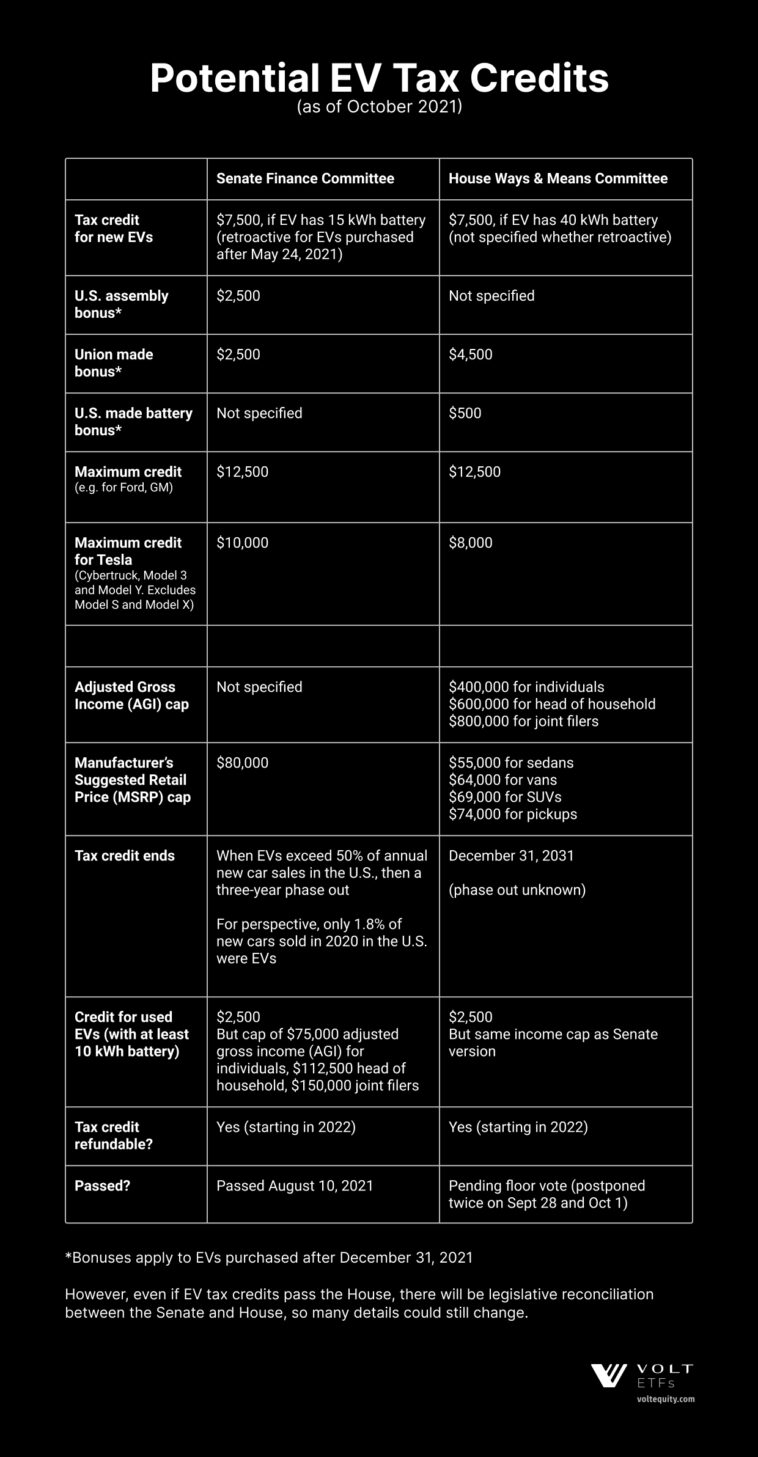

In order to stay well-informed about the ever-evolving landscape of electric vehicle tax credits, it’s crucial to consult a comprehensive guide that covers all aspects of this complex subject. By doing so, you’ll gain a thorough understanding of the qualifying criteria for federal and state incentives, current and upcoming changes in legislation, and the varying tax credit amounts for different electric vehicle models. With a strong grasp of this vital information, you’ll be better equipped to make the most of available financial incentives and seamlessly navigate the intricate world of EV tax credits, ensuring you save both time and money on your journey towards a more sustainable future.

Decoding the Latest EV Tax Credit Updates: What You Need to Know to Maximize Your Savings

Staying informed about the latest EV tax credit updates is crucial to maximize your savings when purchasing an electric vehicle. To make the most of these incentives, regularly check reliable sources like the IRS website, state government websites, and reputable EV news platforms. Being aware of the current federal tax credit phase-out schedule, along with state-specific incentives, will help you make an informed decision on the best time to buy an EV. By understanding the eligibility criteria for various tax credits and rebates, you can confidently choose the right electric vehicle to fit your budget and enjoy the eco-friendly benefits.

Unlocking the Potential of Electric Vehicle Tax Credits: A Step-by-Step Approach to Staying Informed

Staying informed on the latest electric vehicle (EV) tax credit changes is essential for maximizing your savings and making the most of your investment in sustainable transportation. By adopting a step-by-step approach, you can unlock the full potential of these valuable incentives. Begin by regularly checking reliable sources like the official government websites, industry news outlets, and EV manufacturer updates to stay abreast of the latest developments. Additionally, joining forums, social media groups, and subscribing to newsletters centered around EV tax credits can help you stay engaged with the EV community and remain updated on crucial policy changes. With a proactive mindset and access to accurate information, you’ll be well-prepared to capitalize on the ever-evolving landscape of electric vehicle tax incentives.

Electric Vehicle Tax Credit Changes: How to Stay Ahead of the Curve and Secure Your Benefits

Staying ahead of the curve and securing your benefits when it comes to electric vehicle tax credit changes is crucial for maximizing your savings. To keep up-to-date with the latest developments, make sure to regularly visit authoritative websites such as the IRS and Department of Energy (DOE) for accurate information. Additionally, consider subscribing to EV industry newsletters, joining online forums, and following reliable social media accounts focused on electric vehicle news. These sources will provide you with timely updates on any changes to tax credits, ensuring that you’re always aware of the current incentives and benefits available for your EV purchase.

Embracing the Future of EV Tax Credits: Expert Tips for Keeping Up with Legislation and Policy Updates

Embracing the future of EV tax credits requires staying informed on the ever-evolving landscape of legislation and policy updates. To ensure you’re always in the know, follow reliable news sources, subscribe to industry newsletters, and engage in online discussions with experts in electric vehicle tax incentives. Keep an eye on websites of government agencies like the Department of Energy (DOE) and the Internal Revenue Service (IRS) for the latest information. Additionally, consider joining electric vehicle forums or social media groups to exchange knowledge and insights with fellow enthusiasts. Staying connected in this way will empower you to capitalize on the most up-to-date EV tax credit opportunities.

GIPHY App Key not set. Please check settings