Are you looking to save big on your next electric vehicle purchase? Look no further! Our comprehensive guide reveals the secrets to combining federal and state EV tax credits for maximum savings. Unlock the full potential of these green incentives and let your wallet reap the benefits. Say goodbye to range anxiety and hello to a cleaner, greener driving experience. Read on to learn how to navigate the world of electric vehicle tax credits and stack them for the ultimate eco-friendly automotive investment. Don’t miss this electrifying opportunity to save!

Understanding the Basics of Federal and State EV Tax Credits: A Comprehensive Guide

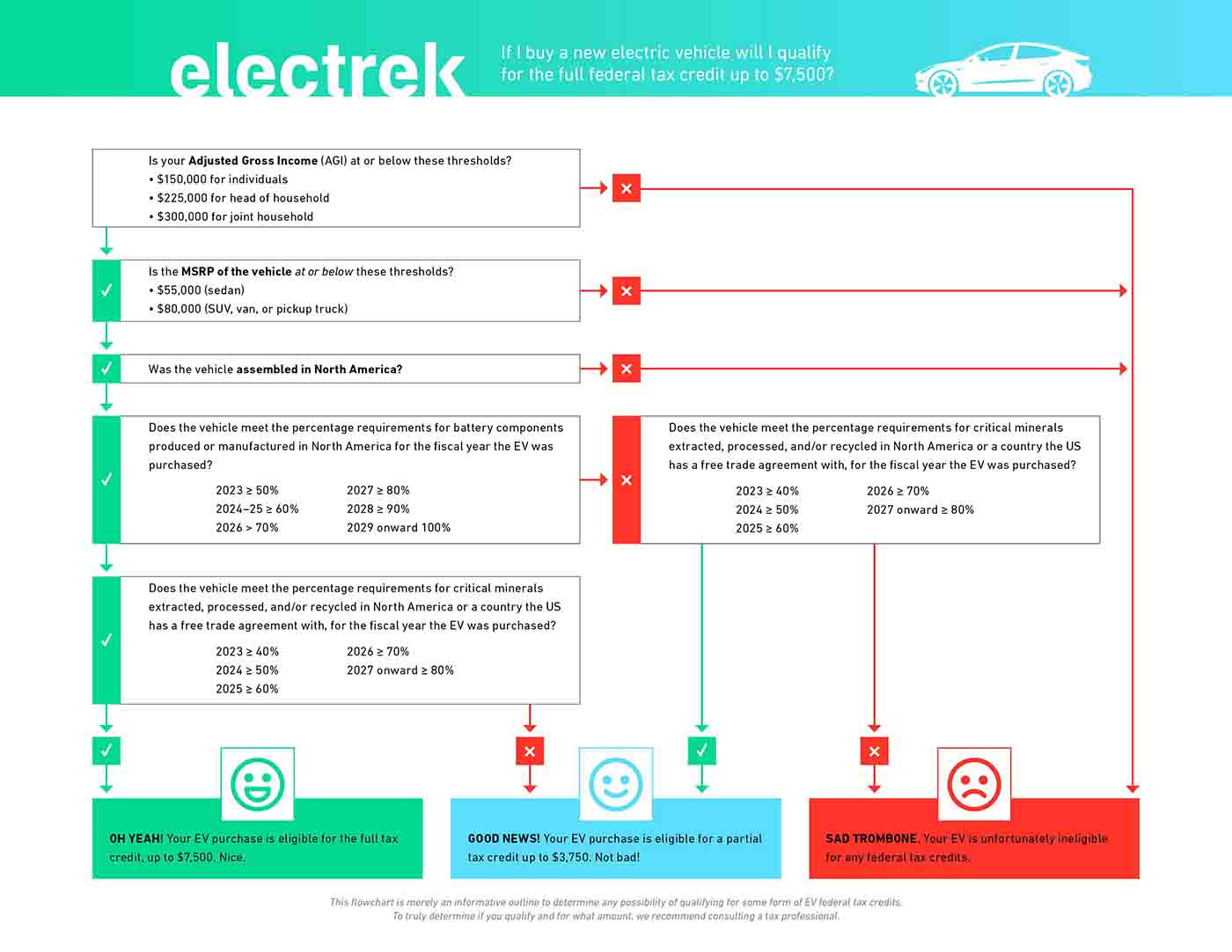

To maximize EV tax credits and savings, it’s essential to be well-informed about both federal and state incentives. Our comprehensive guide will provide you with the necessary knowledge of the basics of these credits, ensuring that you make the most of the available benefits. By understanding the eligibility criteria, credit amounts, and the process to claim these incentives, you’ll be better equipped to make wise decisions while purchasing an electric vehicle. Dive into our detailed guide to learn how to effectively combine federal and state EV tax credits for significant savings, contributing to a more sustainable and eco-friendly lifestyle.

Tips for Maximizing Your Savings: How to Leverage Both Federal and State EV Tax Incentives

When looking to maximize your savings on electric vehicle (EV) purchases, it’s essential to strategically leverage both federal and state EV tax incentives. To get the most out of these financial incentives, stay updated on the latest information regarding federal tax credits, as they are subject to change or expiration. Additionally, research and compare state-specific EV tax incentives, as they can vary greatly. Some states even offer additional perks, such as carpool lane access and free parking. By staying informed and taking advantage of both federal and state EV tax credits, you can significantly reduce the overall cost of your electric vehicle while contributing to a more sustainable future.

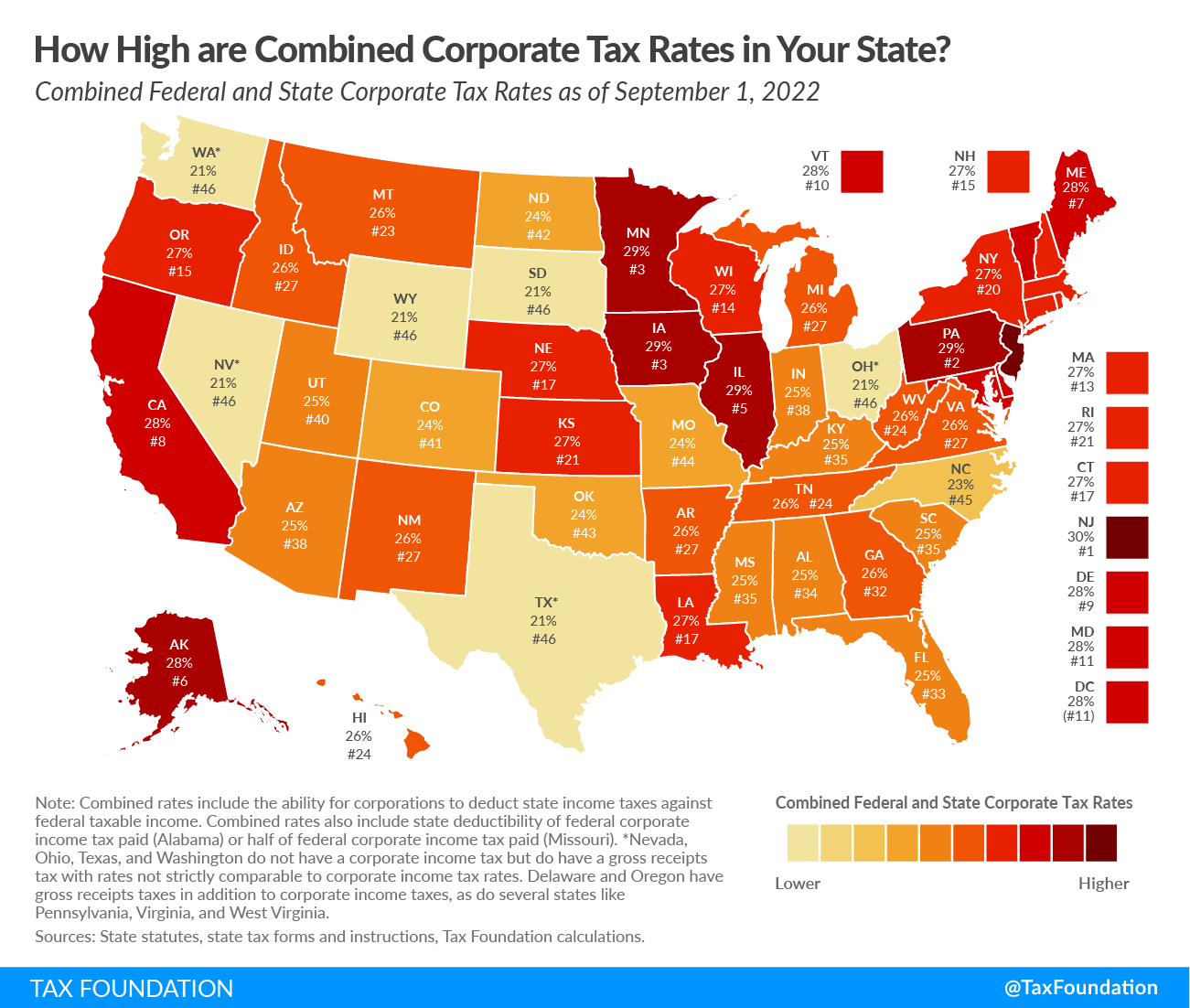

A State-by-State Breakdown: Discover the Best Regions for Combining EV Tax Credits

In our comprehensive state-by-state breakdown, we reveal the top regions for maximizing your savings by combining federal and state EV tax credits. Explore the plethora of incentives available across the United States, including rebates, tax exemptions, and additional perks for electric vehicle owners. Uncover the hidden gems and learn how to strategically benefit from various programs to make your EV purchase more affordable. With our SEO-optimized guide, you’ll be well-equipped to navigate the complex landscape of EV tax credits and discover the best regions to take advantage of these lucrative incentives, ensuring a cost-effective and eco-friendly driving experience.

Navigating the Application Process: A Step-by-Step Guide to Claiming Your EV Tax Credits

To maximize your EV tax credits and enjoy substantial savings, follow our step-by-step guide to navigate the application process seamlessly. Start by familiarizing yourself with federal and state EV tax credit eligibility requirements and keeping track of relevant deadlines. Next, gather essential documents such as purchase agreements, proof of ownership, and registration records. Ensure you accurately complete the necessary tax forms, such as IRS Form 8936 for federal credits and the corresponding state-specific forms. Finally, consult with a tax professional to guarantee you’re claiming all the available incentives and avoid costly errors. Stay informed on the latest EV tax credit updates and reap the benefits of owning an environmentally friendly vehicle.

Case Studies: Real-Life Success Stories of Maximizing Savings through EV Tax Credits Combination

In our quest to maximize savings through EV tax credits, we present real-life case studies that showcase the power of combining federal and state incentives. These success stories demonstrate how savvy EV buyers have taken advantage of the full range of available tax credits, rebates, and other incentives to significantly reduce the cost of their electric vehicles. From first-time EV owners to experienced drivers who’ve upgraded their electric rides, these individuals have strategically navigated the world of EV tax credits to ultimately save thousands of dollars. By learning from their experiences, you too can unlock the true potential of combining federal and state EV tax credits for maximum savings on your next eco-friendly vehicle purchase.

GIPHY App Key not set. Please check settings